Page 10 - MEOG Week 08 2021

P. 10

MEOG POLICY MEOG

Israel to connect Leviathan

to Egyptian LNG terminals

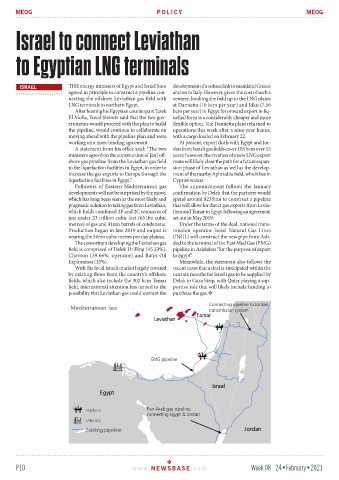

ISRAEL THE energy ministers of Egypt and Israel have development of a subsea link to mainland Greece

agreed in principle to construct a pipeline con- and on to Italy. However, given the cost of such a

necting the offshore Leviathan gas field with venture, hooking the field up to the LNG plants

LNG terminals in northern Egypt. at Damietta (10 bcm per year) and Idku (7.56

After hosting his Egyptian counterpart Tarek bcm per year) in Egypt for onward export in liq-

El Molla, Yuval Steinitz said that the two gov- uefied form is a considerably cheaper and more

ernments would proceed with the plan to build flexible option. The Damietta plant returned to

the pipeline, would continue to collaborate on operations this week after a nine-year hiatus,

moving ahead with the pipeline plan and were with a cargo loaded on February 22.

working on a more binding agreement. At present, export deals with Egypt and Jor-

A statement from his office said: “The two dan from Israeli gas fields cover 105 bcm over 15

ministers agreed on the construction of [an] off- years; however, the creation of a new LNG export

shore gas pipeline from the Leviathan gas field route will likely clear the path for a future expan-

to the liquefaction facilities in Egypt, in order to sion phase of Leviathan as well as the develop-

increase the gas exports to Europe through the ment of the nearby Aphrodite field, which lies in

liquefaction facilities in Egypt.” Cypriot waters.

Followers of Eastern Mediterranean gas The announcement follows the January

developments will not be surprised by the move, confirmation by Delek that the partners would

which has long been seen as the most likely and spend around $235mn to construct a pipeline

pragmatic solution to taking gas from Leviathan, that will allow for direct gas exports from Levia-

which holds combined 2P and 2C resources of than and Tamar to Egypt following an agreement

just under 23 trillion cubic feet (651bn cubic set out in May 2019.

metres) of gas and 41mn barrels of condensate. Under the terms of the deal, national trans-

Production began in late 2019 and output is mission operator Israel Natural Gas Lines

nearing the 34mn cubic metres per day plateau. (INGL) will construct the new pipe from Ash-

The consortium developing the Leviathan gas dod to the terminal of the East Med Gas (EMG)

field is comprised of Delek Drilling (45.33%), pipeline in Ashkelon “for the purpose of export

Chevron (39.66%, operator) and Ratio Oil to Egypt”.

Exploration (15%). Meanwhile, the statement also follows the

With the local Israeli market largely covered recent news that a deal is anticipated within the

by existing flows from the country’s offshore next six months for Israeli gas to be supplied by

fields, which also include the 302 bcm Tamar Delek to Gaza Strip, with Qatar playing a sup-

field, international attention has turned to the portive role that will likely include funding to

possibility that Leviathan gas could warrant the purchase the gas.

P10 www. NEWSBASE .com Week 08 24•February•2021