Page 6 - AsiaElec Week 33 2022

P. 6

AsiaElec COMMENTARY AsiaElec

Tightening green bond rules in

Asia help counter greenwashing,

but more is needed

ASIA

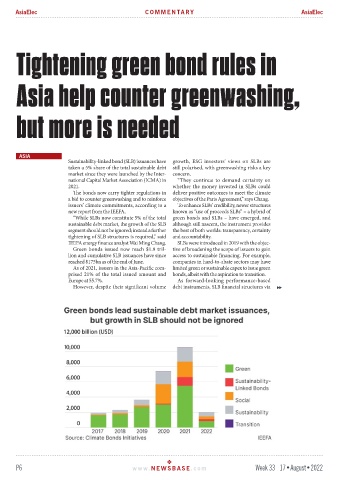

Sustainability-linked bond (SLB) issuances have growth, ESG investors’ views on SLBs are

taken a 5% share of the total sustainable debt still polarised, with greenwashing risks a key

market since they were launched by the Inter- concern.

national Capital Market Association (ICMA) in “They continue to demand certainty on

2021. whether the money invested in SLBs could

The bonds now carry tighter regulations in deliver positive outcomes to meet the climate

a bid to counter greenwashing and to reinforce objectives of the Paris Agreement,” says Chang.

issuers’ climate commitments, according to a To enhance SLBs’ credibility, newer structures

new report from the IEEFA, known as “use of proceeds SLBs” – a hybrid of

“While SLBs now constitute 5% of the total green bonds and SLBs – have emerged, and

sustainable debt market, the growth of the SLB although still nascent, the instrument provides

segment should not be ignored; instead a further the best of both worlds: transparency, certainty

tightening of SLB structures is required,” said and accountability.

IEEFA energy finance analyst Wai Ming Chang. SLBs were introduced in 2019 with the objec-

Green bonds issued now reach $1.9 tril- tive of broadening the scope of issuers to gain

lion and cumulative SLB issuances have since access to sustainable financing. For example,

reached $175bn as of the end of June. companies in hard-to-abate sectors may have

As of 2021, issuers in the Asia-Pacific com- limited green or sustainable capex to issue green

prised 21% of the total issued amount and bonds, albeit with the aspiration to transition.

Europe at 55.7%. As forward-looking performance-based

However, despite their significant volume debt instruments, SLB financial structures via

P6 www. NEWSBASE .com Week 33 17•August•2022