Page 5 - FSUOGM Week 45 2021

P. 5

FSUOGM COMMENTARY FSUOGM

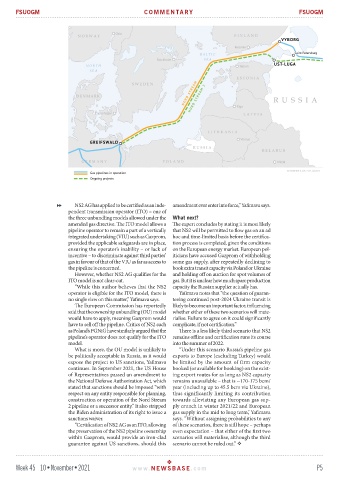

NS2 AG has applied to be certified as an inde- amendment ever enter into force,” Yafimava says.

pendent transmission operator (ITO) – one of

the three unbundling models allowed under the What next?

amended gas directive. The ITO model allows a The expert concludes by stating it is most likely

pipeline operator to remain a part of a vertically that NS2 will be permitted to flow gas on an ad

integrated undertaking (VIU) such as Gazprom, hoc and time-limited basis before the certifica-

provided the applicable safeguards are in place, tion process is completed, given the conditions

ensuring the operator’s inability – or lack of on the European energy market. European pol-

incentive – to discriminate against third parties’ iticians have accused Gazprom of withholding

gas in favour of that of the VIU as far as access to some gas supply, after repeatedly declining to

the pipeline is concerned. book extra transit capacity via Poland or Ukraine

However, whether NS2 AG qualifies for the and holding off on auction for spot volumes of

ITO model is not clear-cut. gas. But it is unclear how much spare production

“While this author believes that the NS2 capacity the Russian supplier actually has.

operator is eligible for the ITO model, there is Yafimava notes that “the question of guaran-

no single view on this matter,” Yafimava says. teeing continued post-2024 Ukraine transit is

The European Commission has reportedly likely to become an important factor, influencing

said that the ownership unbundling (OU) model whether either of these two scenarios will mate-

would have to apply, meaning Gazprom would rialise. Failure to agree on it could significantly

have to sell off the pipeline. Critics of NS2 such complicate, if not certification.”

as Poland’s PGNiG have similarly argued that the There is a less likely third scenario that NS2

pipeline’s operator does not qualify for the ITO remains offline and certification runs its course

model. into the summer of 2022.

What is more, the OU model is unlikely to “Under this scenario Russia’s pipeline gas

be politically acceptable in Russia, as it would exports to Europe (excluding Turkey) would

expose the project to US sanctions, Yafimava be limited by the amount of firm capacity

continues. In September 2021, the US House booked (or available for booking) on the exist-

of Representatives passed an amendment to ing export routes for as long as NS2 capacity

the National Defense Authorization Act, which remains unavailable – that is ~170-175 bcm/

stated that sanctions should be imposed “with year (including up to 45.5 bcm via Ukraine),

respect on any entity responsible for planning, thus significantly limiting its contribution

construction or operation of the Nord Stream towards alleviating any European gas sup-

2 pipeline or a successor entity.” It also stripped ply crunch in winter 2021/22 and European

the Biden administration of its right to issue a gas supply in the mid to long term,’ Yafimava

sanctions waiver. says. “Without assigning probabilities to any

“Certification of NS2 AG as an ITO, allowing of these scenarios, there is still hope – perhaps

the preservation of the NS2 pipeline ownership even expectation – that either of the first two

within Gazprom, would provide an iron-clad scenarios will materialise, although the third

guarantee against US sanctions, should this scenario cannot be ruled out.”

Week 45 10•November•2021 www. NEWSBASE .com P5