Page 7 - FSUOGM Week 45 2021

P. 7

FSUOGM COMMENTARY FSUOGM

Market weighs up UNG's

eurobond sale

Rating agencies estimate that major projects to be completed in coming years might increase

company’s Ebitda by more than 50% and contribute to the issuer’s deleveraging

UZBEKISTAN STATE-OWNED Uzbekneftegaz (UNG), an

oil and gas producer, is marketing its debut

USD-denominated eurobond with a tenor of five

and/or 10 years, according to preliminary deal

terms unveiled by VTB Capital.

UNG to date controls around 50% of hydro-

carbon deposits in Uzbekistan. In 2020, UNG

accounted for 67% of Uzbekistan’s gas extrac-

tion and generated 85% of the country’s electric

power, contributing 3.5% of Uzbekistan’s GDP.

The company’s production (33.1bn cubic metres

(bcm) of natural gas and 1.6mn tonnes of liquid

hydrocarbons in 2020) has been on a downtrend

in recent years, reflecting a lack of investment in

exploration in the past.

Fitch and S&P rated UNG on par with Uzbek-

istan’s sovereign rating (i.e. at BB- with a ‘Stable’

outlook), thanks to the issuer’s strong ties with

the state. Among other things, the state support

for the company is reflected in state-debt guaran-

tees, covering some 80% of the issuer’s total debt

at YE20, and the practice of debt to equity swaps,

which reduced UNG’s total debt by $1.7bn in

2020 to $3.3bn. Fixed gas tariffs constrain the

company's financial performance.

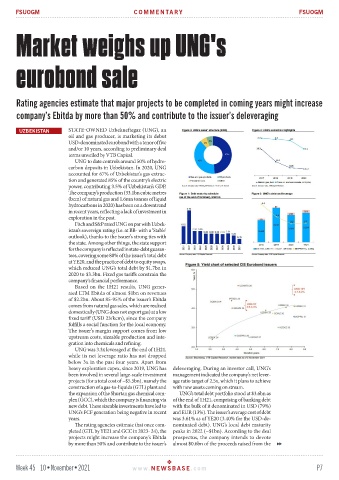

Based on the 1H21 results, UNG gener-

ated LTM Ebitda of almost $1bn on revenues

of $2.2bn. About 85-95% of the issuer’s Ebitda

comes from natural gas sales, which are realised

domestically (UNG does not export gas) at a low

fixed tariff (USD 23/kcm), since the company

fulfills a social function for the local economy.

The issuer’s margin support comes from low

upstream costs, sizeable production and inte-

gration into chemicals and refining.

UNG was 3.3x leveraged at the end of 1H21,

while its net leverage ratio has not dropped

below 3x in the past four years. Apart from

heavy exploration capex, since 2019, UNG has deleveraging. During an investor call, UNG’s

been involved in several large-scale investment management indicated the company’s net lever-

projects (for a total cost of ~$5.5bn), namely the age ratio target of 2.5x, which it plans to achieve

construction of a gas-to-liquids (GTL) plant and with new assets coming on stream.

the expansion of the Shurtan gas chemical com- UNG’s total debt portfolio stood at $3.6bn as

plex (GCC), which the company is financing via of the end of 1H21, comprising of banking debt

new debt. These sizeable investments have led to with the bulk of it denominated in USD (79%)

UNG’s FCF generation being negative in recent and EUR (13%). The issuer’s average cost of debt

years. was 3.61% as of YE20 (3.40% for the USD-de-

The rating agencies estimate that once com- nominated debt). UNG’s local debt maturity

pleted (GTL by YE21 and GCC in 2023- 24), the peaks in 2022 (~$1bn). According to the deal

projects might increase the company’s Ebitda prospectus, the company intends to devote

by more than 50% and contribute to the issuer’s almost $0.6bn of the proceeds raised from the

Week 45 10•November•2021 www. NEWSBASE .com P7