Page 5 - AsiaElec Week 06 2021

P. 5

AsiaElec COMMENTARY AsiaElec

coal and oil bear the brunt of the reduction in improvements to the financial health of many

demand, it does not move India any closer to its electricity distribution companies and other

long-term sustainable development goals. reform efforts.

Alongside oil, reducing India’s reliance on

Oil dependency coal is crucial to the energy transition. The IEA

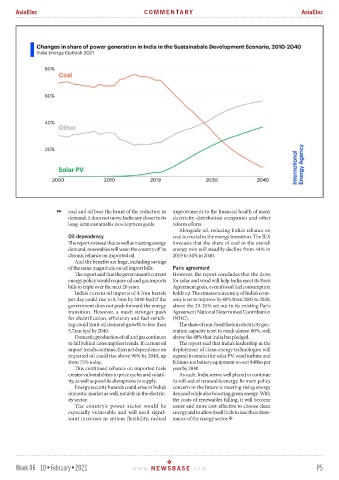

The report stressed that as well as meeting energy forecasts that the share of coal in the overall

demand, renewables will wean the country off its energy mix will steadily decline from 44% in

chronic reliance on imported oil. 2019 to 34% in 2040.

And the benefits are huge, including savings

of the same magnitude on oil import bills. Paris agreement

The report said that the government’s current However, the report concludes that the drive

energy policy would require oil and gas imports for solar and wind will help India meet its Paris

bills to triple over the next 20 years. Agreement goals, even if fossil fuel consumption

India’s current oil imports of 4.7mn barrels holds up. The emissions intensity of India’s econ-

per day could rise to 8.7mn by 2040 bpd if the omy is set to improve by 40% from 2005 to 2030,

government does not push forward the energy above the 33-35% set out in its existing Paris

transition. However, a much stronger push Agreement National Determined Contribution

for electrification, efficiency and fuel switch- (NDC).

ing could limit oil demand growth to less than The share of non-fossil fuels in electricity gen-

5.7mn bpd by 2040. eration capacity is set to reach almost 60%, well

Domestic production of oil and gas continues above the 40% that India has pledged.

to fall behind consumption trends. If current oil The report said that India’s leadership in the

import trends continue, then net dependence on deployment of clean energy technologies will

imported oil could rise above 90% by 2040, up expand its market for solar PV, wind turbine and

from 75% today. lithium-ion battery equipment to over $40bn per

This continued reliance on imported fuels year by 2040.

creates vulnerabilities to price cycles and volatil- As such, India seems well placed to continue

ity, as well as possible disruptions to supply. its roll-out of renewable energy. Its main policy

Energy security hazards could arise in India’s concern in the future is meeting rising energy

domestic market as well, notably in the electric- demand while also boosting green energy. With

ity sector. the costs of renewables falling, it will become

The country’s power sector would be easier and more cost-effective to choose clean

especially vulnerable and will need signif- energy and to allow fossil fuels to lose their dom-

icant increases in system flexibility, radical inance of the energy sector.

Week 06 10•February•2021 www. NEWSBASE .com P5