Page 5 - MEOG Week 41 2022

P. 5

MEOG COMMENTARY MEOG

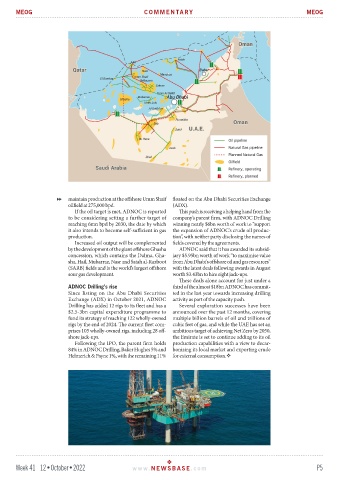

maintain production at the offshore Umm Shaif floated on the Abu Dhabi Securities Exchange

oilfield at 275,000 bpd. (ADX).

If the oil target is met, ADNOC is reported This push is receiving a helping hand from the

to be considering setting a further target of company’s parent firm, with ADNOC Drilling

reaching 6mn bpd by 2030, the date by which winning nearly $6bn worth of work to “support

it also intends to become self-sufficient in gas the expansion of ADNOC’s crude oil produc-

production. tion”, with neither party disclosing the names of

Increased oil output will be complemented fields covered by the agreements.

by the development of the giant offshore Ghasha ADNOC said that it has awarded its subsid-

concession, which contains the Dalma, Gha- iary $5.95bn worth of work “to maximise value

sha, Hail, Mubarraz, Nasr and Satah al-Razboot from Abu Dhabi’s offshore oil and gas resources”

(SARB) fields and is the world’s largest offshore with the latest deals following awards in August

sour gas development. worth $3.43bn to hire eight jack-ups.

These deals alone account for just under a

ADNOC Drilling’s rise third of the almost $18bn ADNOC has commit-

Since listing on the Abu Dhabi Securities ted in the last year towards increasing drilling

Exchange (ADX) in October 2021, ADNOC activity as part of the capacity push.

Drilling has added 12 rigs to its fleet and has a Several exploration successes have been

$2.5-3bn capital expenditure programme to announced over the past 12 months, covering

fund its strategy of reaching 122 wholly-owned multiple billion barrels of oil and trillions of

rigs by the end of 2024. The current fleet com- cubic feet of gas, and while the UAE has set an

prises 105 wholly-owned rigs, including 28 off- ambitious target of achieving Net Zero by 2050,

shore jack-ups. the Emirate is set to continue adding to its oil

Following the IPO, the parent firm holds production capabilities with a view to decar-

84% in ADNOC Drilling, Baker Hughes 5% and bonising its local market and exporting crude

Helmerich & Payne 1%, with the remaining 11% for external consumption.

Week 41 12•October•2022 www. NEWSBASE .com P5