Page 11 - FSUOGM Week 02 2023

P. 11

FSUOGM COMMENTARY FSUOGM

and subsequently having their supply cut off. does not provide grounds for Russian gas supply

Others, including Germany, agreed to meet the to be resumed to those buyers that had that sup-

new terms. Russian pipeline gas supply to Europe ply cut off. Instead, it only refers to outstanding

shrank, only to drop further after Gazprom cur- debts for supplies delivered after the first decree

tailed supply via the Nord Stream 1 pipeline over came into force. But it could represent a carrot

the summer. that Gazprom is offering to those buyers it previ-

The new decree, amending the previous one, ously shunned.

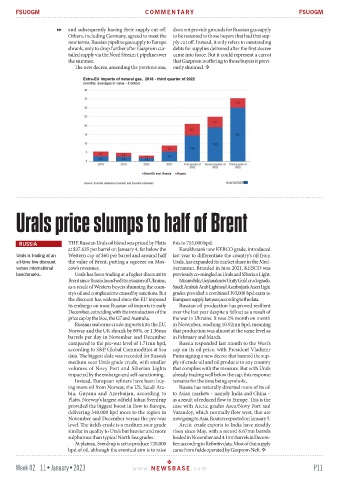

Urals price slumps to half of Brent

RUSSIA THE Russian Urals oil blend was priced by Platts this to 755,000 bpd.

at $37.635 per barrel on January 4, far below the Kazakhstan’s new KEBCO grade, introduced

Urals is trading at an Western cap of $60 per barrel and around half last year to differentiate the country’s oil from

all-time low discount the value of Brent, putting a squeeze on Mos- Urals, has expanded its market share in the Med-

versus international cow’s revenues. iterranean. Branded in June 2021, KEBCO was

benchmarks. Urals has been trading at a higher discount to previously co-mingled as Urals and Siberian Light.

Brent since Russia launched its invasion of Ukraine, Meanwhile, Guyana’s new Unity Gold crude grade,

as a result of Western buyers shunning the coun- Saudi Arabia’s Arab Light and Azerbaijan’s Azeri Light

try’s oil and complications caused by sanctions. But grades provided a combined 393,000 bpd extra to

the discount has widened since the EU imposed European supply last year, according to the data.

its embargo on most Russian oil imports in early Russian oil production has proved resilient

December, coinciding with the introduction of the over the last year despite a fallout as a result of

price cap by the bloc, the G7 and Australia. the war in Ukraine. It rose 2% month on month

Russian seaborne crude imports into the EU, in November, reaching 10.92mn bpd, meaning

Norway and the UK shrank by 80%, or 1.36mn that production was almost at the same level as

barrels per day in November and December in February and March.

compared to the pre-war level of 1.71mn bpd, Russia responded last month to the West’s

according to S&P Global Commodities at Sea cap on its oil price, with President Vladimir

data. The biggest slide was recorded for Russia’s Putin signing a new decree that banned the sup-

medium sour Urals grade crude, with smaller ply of crude oil and oil products to any country

volumes of Novy Port and Siberian Lights that complies with the measure. But with Urals

impacted by the embargo and self-sanctioning. already trading well below the cap, this response

Instead, European refiners have been buy- remains for the time being symbolic.

ing more oil from Norway, the US, Saudi Ara- Russia has naturally diverted more of its oil

bia, Guyana and Azerbaijan, according to to Asian markets – namely India and China –

Platts. Norway’s largest oilfield Johan Sverdrup as a result of reduced flow to Europe. This is the

provided the biggest boost in flow to Europe, case with Arctic grades Arco/Novy Port and

delivering 340,000 bpd more to the region in Varandey, which normally flow west, that are

November and December versus the pre-war now going to Asia, Reuters reported on January 5.

level. The field’s crude is a medium sour grade Arctic crude exports to India have steadily

similar in quality to Urals but heavier and more risen since May, with a record 6.67mn barrels

sulphurous than typical North Sea grades. loaded in November and 4.1mn barrels in Decem-

At plateau, Sverdrup is set to produce 720,000 ber, according to Refinitiv data. Most of that supply

bpd of oil, although the eventual aim is to raise came from fields operated by Gazprom Neft.

Week 02 11•January•2023 www. NEWSBASE .com P11