Page 8 - FSUOGM Week 02 2023

P. 8

FSUOGM FSUOGM

Gazprom's gas exports to countries out- in 2021 worse.

side the ex-Soviet Union will fall to 100.9 bcm This year has been a repeat of the winter of

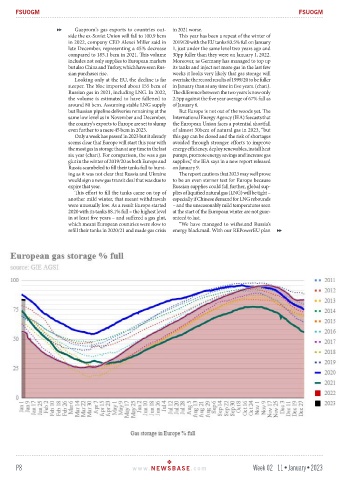

in 2022, company CEO Alexei Miller said in 2019/20 with the EU tanks 83.5% full on January

late December, representing a 45% decrease 1, just under the same level two years ago and

compared to 185.1 bcm in 2021. This volume 30pp fuller than they were on January 1, 2022.

includes not only supplies to European markets Moreover, as Germany has managed to top up

but also China and Turkey, which have seen Rus- its tanks and inject net more gas in the last few

sian purchases rise. weeks it looks very likely that gas storage will

Looking only at the EU, the decline is far overtake the record results of 1999/20 to be fuller

steeper. The bloc imported about 155 bcm of in January than at any time in five years. (chart).

Russian gas in 2021, including LNG. In 2022, The difference between the two years is now only

the volume is estimated to have fallened to 2.5pp against the five year average of 67% full as

around 80 bcm. Assuming stable LNG supply of January 6.

but Russian pipeline deliveries remaining at the But Europe is not out of the woods yet. The

same low level as in November and December, International Energy Agency (IEA) foecasts that

the country's exports to Europe are set to slump the European Union faces a potential shortfall

even further to a mere 45 bcm in 2023. of almost 30bcm of natural gas in 2023, “but

Only a week has passed in 2023 but it already this gap can be closed and the risk of shortages

seems clear that Europe will start this year with avoided through stronger efforts to improve

the most gas in storage than at any time in the last energy efficiency, deploy renewables, install heat

six year (chart). For comparison, the was a gas pumps, promote energy savings and increase gas

glut in the winter of 2019/20 as both Europe and supplies,” the IEA says in a new report released

Russia scambeled to fill their tanks full to burst- on January 9.

ing as it was not clear that Russia and Ukraine The report cautions that 2023 may well prove

would sign a new gas transit deal that was due to to be an even sterner test for Europe because

expire that year. Russian supplies could fall further, global sup-

This effort to fill the tanks came on top of plies of liquified natural gas (LNG) will be tight –

another mild winter, that meant withdrawals especially if Chinese demand for LNG rebounds

were unusually low. As a result Europe started – and the unseasonably mild temperatures seen

2020 with its tanks 88.1% full – the highest level at the start of the European winter are not guar-

in at least five years – and suffered a gas glut, anteed to last.

which meant European countries were slow to “We have managed to withstand Russia’s

refill their tanks in 2020/21 and made gas crisis energy blackmail. With our REPowerEU plan

P8 www. NEWSBASE .com Week 02 11•January•2023