Page 6 - FSUOGM Week 02 2023

P. 6

FSUOGM COMMENTARY FSUOGM

livered to the EU in 2021. Last year, the volume economy ministry, the terminals will be able to

of supplies from the Russian Federation fell by provide a third of Germany's natural gas needs.

more than half to 60bn cubic meters. As a re- Meeting Germany’s demand for gas is impor-

sult, the EU imported 24%, Japan 17%, China tant for the rest of Europe as it has by far the larg-

15%, and South Korea 11% of total global LNG est gas storage tanks in EU and supplies gas to

deliveries. The share of liquefied gas in Europe's many other European countries, including Italy,

consumption increased 1.75 times, from 20% which is the second biggest gas importer after

to 35%, while the share of Russian gas fell to a Germany.

third of its previous level, from 40% to 15%. Russian LNG supplies have not been

Germany is the largest market for natural impacted by the fallout from the war in Ukraine.

gas in Europe and until recently had Russia as Indeed, the Russian government estimates it

its largest supplier, although this position is now shipped 21 bcm of LNG last year to Europe, sig-

held by Norway, which has ramped up pipe gas nificantly up on the level in 2021. But Russia has

supply to the country over recent months. But lost some markets including the UK, whose gov-

the country is also rushing into operation five ernment on January 1 ended all LNG imports

LNG terminals over the coming years. Depend- from the country.

ent on Russian piped gas for decades, Germany The UK imported 3.12 bcm of Russian gas

was one of the few coastal EU countries that had or 4% from total consumption of this kind of

ignored LNG until the war in Ukraine made fuel last year. Imports of Russian gas declined

its dependency on Russia piped gas a glaring dramatically after the start of the Russian spe-

problem. cial military operation in Ukraine. The UK con-

On December 17, the first of these LNG sumes about 75 bcm of gas in average per year.

terminals was commissioned for service in the

port of Wilhelmshaven. The floating terminal Tanks and weather

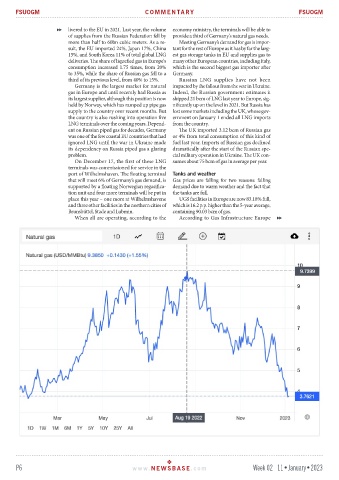

that will meet 6% of Germany’s gas demand, is Gas prices are falling for two reasons: falling

supported by a floating Norwegian regasifica- demand due to warm weather and the fact that

tion unit and four more terminals will be put in the tanks are full.

place this year – one more at Wilhelmshavene UGS facilities in Europe are now 83.18% full,

and three other facilities in the northern cities of which is 16.2 p.p. higher than the 5-year average,

Brunsbüttel, Stade and Lubmin. containing 90.03 bcm of gas.

When all are operating, according to the According to Gas Infrastructure Europe

P6 www. NEWSBASE .com Week 02 11•January•2023