Page 5 - FSUOGM Week 02 2023

P. 5

FSUOGM COMMENTARY FSUOGM

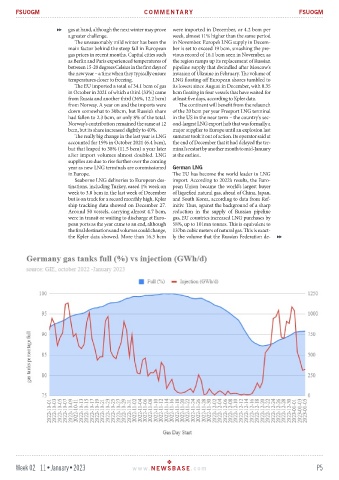

gas at hand, although the next winter may prove were imported in December, or 4.2 bcm per

a greater challenge. week, almost 11% higher than the same period

The unseasonably mild winter has been the in November. Europe’s LNG supply in Decem-

main factor behind the steep fall in European ber is set to exceed 19 bcm, smashing the pre-

gas prices in recent months. Capital cities such vious record of 16.1 bcm seen in November, as

as Berlin and Paris experienced temperatures of the region ramps up its replacement of Russian

between 15-20 degrees Celsius in the first days of pipeline supply that dwindled after Moscow’s

the new year – a time when they typically ensure invasion of Ukraine in February. The volume of

temperatures closer to freezing. LNG floating off European shores tumbled to

The EU imported a total of 34.1 bcm of gas its lowest since August in December, with 0.35

in October in 2021 of which a third (33%) came bcm floating in four vessels that have waited for

from Russia and another third (36%, 12.2 bcm) at least five days, according to Kpler data.

from Norway. A year on and the imports were The continent will benefit from the relaunch

down somewhat to 30bcm, but Russia’s share of the 20 bcm per year Freeport LNG terminal

had fallen to 2.3 bcm, or only 8% of the total. in the US in the near term – the country's sec-

Norway’s contribution remained the same at 12 ond-largest LNG export hub that was formally a

bcm, but its share increased slightly to 40%. major supplier to Europe until an explosion last

The really big change in the last year is LNG summer took it out of action. Its operator said at

accounted for 19% in October 2021 (6.4 bcm), the end of December that it had delayed the ter-

but that leaped to 38% (11.5 bcm) a year later minal's restart by another month to mid-January

after import volumes almost doubled. LNG at the earliest.

supplies are due to rise further over the coming

year as new LNG terminals are commissioned German LNG

in Europe. The EU has become the world leader in LNG

Seaborne LNG deliveries to European des- import. According to 2022’s results, the Euro-

tinations, including Turkey, eased 1% week on pean Union became the world's largest buyer

week to 3.8 bcm in the last week of December of liquefied natural gas, ahead of China, Japan,

but is on track for a record monthly high, Kpler and South Korea, according to data from Ref-

ship tracking data showed on December 27. initiv. Thus, against the background of a sharp

Around 50 vessels, carrying almost 4.7 bcm, reduction in the supply of Russian pipeline

were in transit or waiting to discharge at Euro- gas, EU countries increased LNG purchases by

pean ports as the year came to an end, although 58%, up to 101mn tonnes. This is equivalent to

the final destinations and volumes could change, 137bn cubic meters of natural gas. This is exact-

the Kpler data showed. More than 16.3 bcm ly the volume that the Russian Federation de-

Week 02 11•January•2023 www. NEWSBASE .com P5