Page 6 - FSUOGM Week 09 2023

P. 6

FSUOGM COMMENTARY FSUOGM

oil in the sixth, but a softer oil price cap scheme forced to cut production. The size of the cut var-

in the eighth that is designed to allow the EU to ies according to different reports: the Financial

import Russian oil, but cut the Kremlin off from Times quoted experts as saying the cut could

making any real money from the trade. A second be anything between 700,000 bpd up to 1.5mn

round of the same sanctions was introduced on bpd, where Macro Advisory estimates the cut

February 5 that targets oil products. will come in at about 1mn bpd.

As bne IntelliNews has already reported, “Russia needs more than 240 tankers to keep

there has been significant leakage with the exist- its current exports flowing,” Viktor Kurilov, an

ing oil sanctions. Dodges like ship-to-ship trans- analyst at Rystad, told the FT.

fers of oil to hide its origin are already happening, And Russia has already announced that it will

and mixing “crude cocktails”, adding Russian cut production by 500,000 bpd in March, leading

crude to other blends to mask its origin, has also some to speculate that the logistics bottleneck

been reported. When Iranian oil was sanctioned had already been making itself felt, although

it started cutting “compensation deals”, where it others believe that the Kremlin was attempting

would take the sanction-enforced prices, but cut to manipulate prices.

deals with buyers who would then overpay for “I think that they are just testing the waters

other non-sanctioned commodities like wheat. to see what happens if they restrict production,”

Ships remain the mainstay of Russian oil Chris Weafer, the founder and CEO of Macro

exports. There have already been a number of Advisory and former head of research at mul-

investigations trying to work out how big the tiple Moscow-based investment banks, told bne

fleet is. The ghost fleet is a problem, as it blows IntelliNews in a recent podcast on oil sanctions.

a hole in the attempt to sanction Russia’s oil “It’s also a warning that Russia could weaponise

exports, but the jury remains out on how effec- [oil] if things in Ukraine go badly.”

tive the embargoes are. The Kremlin, shortly after announcing the

The size of the ghost fleet is important, as production cut, clarified it would only last one

the lack of tankers will be a serious bottleneck, month and seaborne departures of oil have not

since without enough tankers Russia will be fallen in February.

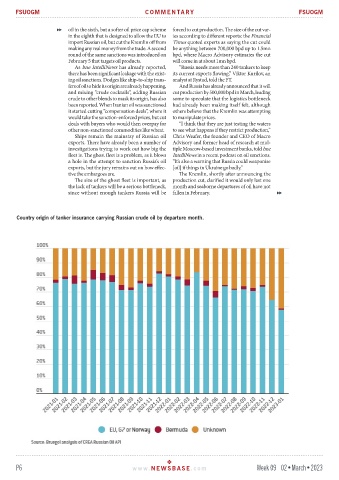

Country origin of tanker insurance carrying Russian crude oil by departure month.

P6 www. NEWSBASE .com Week 09 02•March•2023