Page 15 - Kazakh Outlook 2022

P. 15

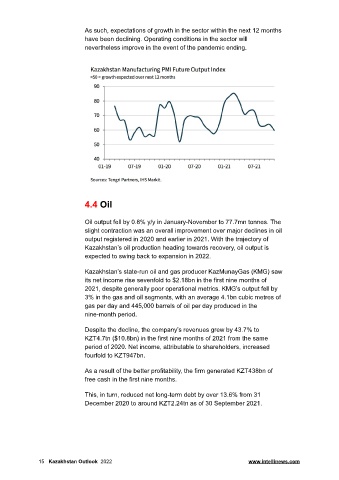

As such, expectations of growth in the sector within the next 12 months

have been declining. Operating conditions in the sector will

nevertheless improve in the event of the pandemic ending.

4.4 Oil

Oil output fell by 0.8% y/y in January-November to 77.7mn tonnes. The

slight contraction was an overall improvement over major declines in oil

output registered in 2020 and earlier in 2021. With the trajectory of

Kazakhstan’s oil production heading towards recovery, oil output is

expected to swing back to expansion in 2022.

Kazakhstan’s state-run oil and gas producer KazMunayGas (KMG) saw

its net income rise sevenfold to $2.18bn in the first nine months of

2021, despite generally poor operational metrics. KMG’s output fell by

3% in the gas and oil segments, with an average 4.1bn cubic metres of

gas per day and 445,000 barrels of oil per day produced in the

nine-month period.

Despite the decline, the company’s revenues grew by 43.7% to

KZT4.7tn ($10.8bn) in the first nine months of 2021 from the same

period of 2020. Net income, attributable to shareholders, increased

fourfold to KZT947bn.

As a result of the better profitability, the firm generated KZT438bn of

free cash in the first nine months.

This, in turn, reduced net long-term debt by over 13.6% from 31

December 2020 to around KZT2.24tn as of 30 September 2021.

15 Kazakhstan Outlook 2022 www.intellinews.com