Page 14 - Kazakh Outlook 2022

P. 14

In Fitch's view, “since the start of the pandemic loan quality of Kazakh

banks has turned out to be stronger compared with our expectations.”

“However, large stocks of legacy problematic loans remain on the

balance sheets of some banks,” Fitch added. “By mid-2021, all the

larger banks had published their annual IFRS accounts, and Fitch

estimates the sector’s average impaired loans (Stage 3 and purchased

or originated credit-impaired loans under IFRS 9) at a high 17% of

gross loans. This is a moderate 300bp reduction from end-2019’s,

mostly due to some recoveries (notably in Halyk) and problem asset

transfers (ATF).”

The loss absorption capacity of most Kazakh banks is supported by

robust asset structures, strong pre-impairment profitability and large

capital buffers, Fitch noted. Nevertheless, a few banks for which the

ratios of net impaired loans relative to capital are particularly still high

remain - the capital ratios and pre-impairment profitability of these

banks remain weaker, compared with the sector’s average.

4.3 Manufacturing

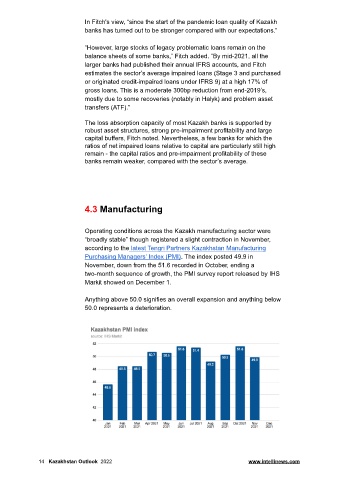

Operating conditions across the Kazakh manufacturing sector were

“broadly stable” though registered a slight contraction in November,

according to the latest Tengri Partners Kazakhstan Manufacturing

Purchasing Managers’ Index (PMI). The index posted 49.9 in

November, down from the 51.6 recorded in October, ending a

two-month sequence of growth, the PMI survey report released by IHS

Markit showed on December 1.

Anything above 50.0 signifies an overall expansion and anything below

50.0 represents a deterioration.

14 Kazakhstan Outlook 2022 www.intellinews.com