Page 7 - FSUOGM Week 15 2022

P. 7

FSUOGM COMMENTARY FSUOGM

a Russian-controlled oil pipeline without break- Reversing the flow would cost billions of dollars

ing the law. German media have reported that in new infrastructure that would take years to

the energy ministry is looking into whether a prepare.

state takeover could be justified in the name of Most Russian exports come from fields in

energy security. West Siberia and the Volga-Urals basin and over

It will be much more difficult for Europe- 80% of them are destined for Europe. Some vol-

ans to agree on a ban on oil imports than on a umes travel via the Druzhba pipeline (opened in

coal embargo, as all 27 EU countries must give 1964) directly to European refineries. Others are

their assent in order to impose sanctions. And shipped by tanker out of the Black Sea and the

the ban will make oil even more expensive for Baltic on short runs to Europe. En route out of

the customers. A complete ban on imports of Russia, 45% of Western exports are processed

Russian oil, according to the Oxford Institute through one of the two dozen refineries in West-

for Energy Studies (OIES), will cause oil prices ern Russia, says Kennedy.

to rise by another 21% compared to the current Russia’s eastern export infrastructure is young

“self-sanctions” scenario, in which Western com- and modest in comparison to its Western coun-

panies voluntarily refuse to deal with Russian terpart. The first long-haul export pipeline from

oil. A new jump in fuel prices could undermine West Siberia to China reached full capacity only

public support for EU sanctions against Russia, in 2019. At 4,188 km, it is the world’s longest oil

writes the FT, citing European officials. pipeline and took over a dozen years to complete

at a cost of some $25bn. It can deliver 600,000

Export diversification bpd directly to China’s Daqing refinery and

Putin has said that if Europe bans Russian oil he another 1mn bpd to Russia’s Pacific oil terminal

will simply export it elsewhere. Easier said than at Kozmino. But this totals only about a fifth of

done. While countries like India, China and Russia’s Western export capacity. Additionally,

Indonesia would happily buy more Russian oil two much smaller terminals send exports out

– especially discounted oil – they simply do not of Sakhalin Island. Russia’s eastern export infra-

have the capacity to absorb all the oil currently structure is already running at near capacity.

being sent to Europe. If Russia wanted to divert significant west-

Asia is home to the largest and third-largest ern export volumes to Asia, it would have to

oil importers in the world, China and India. move them by tanker from terminals in the

Large as they are, however, the collective West Black Sea and the Baltic. Rerouting all those

is far larger – importing double the quantity western volumes would put well over 1mn bpd

that China and India combined buy in. of additional load on Russia’s main sea termi-

At present, Russia supplies only 9% of China nals. That would demand the employment of

and India’s combined oil imports. Were they to a quarter of the world’s supertankers, or about

try to absorb the volumes Russia normally sells 200 dedicated VLCCs (very large crude carri-

to the West, their dependency on Russia for ers). Russia has its own tanker fleet, but that

imported oil would jump to nearly 45%. Both only has the capacity to carry a tenth of the

countries have a policy of keeping their supplies necessary volumes. Moreover, chartering these

of oil diversified. tankers could easily be put out of Russia’s reach

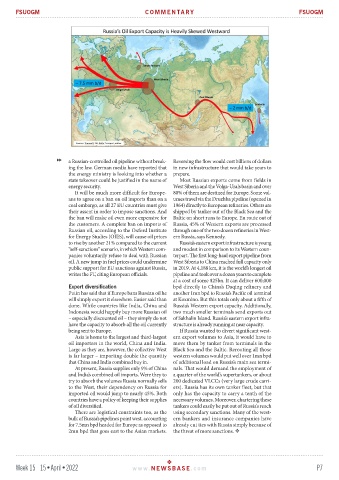

There are logistical constraints too, as the using secondary sanctions. Many of the west-

bulk of Russia’s pipelines point west, accounting ern bankers and insurance companies have

for 7.5mn bpd headed for Europe as opposed to already cut ties with Russia simply because of

2mn bpd that goes east to the Asian markets. the threat of more sanctions.

Week 15 15•April•2022 www. NEWSBASE .com P7