Page 11 - FSUOGM Week 15 2022

P. 11

FSUOGM COMMENTARY FSUOGM

are also past their peak and are currently maxed convert the payment into rubles to meet a new

out. There is no spare capacity to increase sales to requirement set by President Vladimir Putin,

the rest of Europe. Foreign Minister Peter Szijjarto told reporters

during a break at a meeting of EU foreign min-

Germany hardest hit isters in Luxembourg on April 11. EU President

So far Lithuania is the only European country to Ursula von der Leyen accused Budapest of sanc-

have cut off Russian gas, but its two Baltic neigh- tions busting. Szijjarto countered that the deal

bours have not. was nothing to do with the EU, as it is a contract

“From this moment on – no more Rus- between two parties and the currency could be

sian gas in Lithuania,” President Gitanas changed if both sides agreed.

Nauseda tweeted on April 2. “Years ago my coun- Serbia, another close Russian ally, has also

try made decisions that today allow us with no agreed to pay for its new long-term contract in

pain to break energy ties with the aggressor. If we rubles.

can do it, the rest of Europe can do it too!” Western Europe has been resisting the rubles-

Lithuania gets its gas supplies through the for-gas deal and will be hurt far more by the

Klaipeda LNG terminal, so halting supplies was potential ban on Russian hydrocarbons. Ger-

simple. Its neighbours Latvia, Estonia and Fin- many is the most exposed.

land operate in a common market and are tied Analysis by Econtribute offers a range of

into the Russian infrastructure. estimates, but their worst-case number is that

“It is mainly because of the Latvians that the an embargo on Russian gas would temporar-

supply from Gazprom is there, because of the ily reduce Germany’s real GDP by 2.1%. Other

Inchukalnis storage facility and because the estimates put the contraction at 3% of GDP.

Latvians have gas-fired power plants. This is the Germany is the world’s biggest gas importer and

reason why Gazprom’s gas enters our market,” gets around 95% of its gas consumption from

explained Virgilijus Poderys, director of the Lith- imports, according to the BGR.

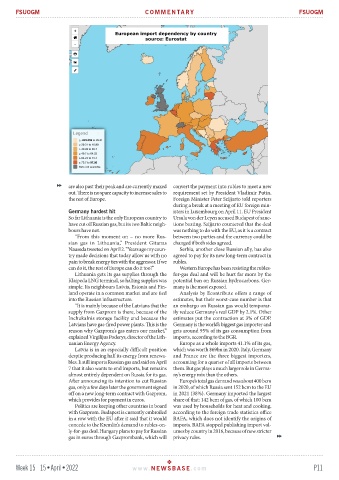

uanian Energy Agency. Europe as a whole imports 41.1% of its gas,

Latvia is in an especially difficult position which was worth $69bn in 2020. Italy, Germany

despite producing half its energy from renewa- and France are the three biggest importers,

bles. It still imports Russian gas and said on April accounting for a quarter of all imports between

7 that it also wants to end imports, but remains them. But gas plays a much larger role in Germa-

almost entirely dependent on Russia for its gas. ny’s energy mix than the others.

After announcing its intention to cut Russian Europe’s total gas demand was about 400 bcm

gas, only a few days later the government signed in 2020, of which Russia sent 152 bcm to the EU

off on a new long-term contract with Gazprom, in 2021 (38%). Germany imported the largest

which provides for payment in euros. share of that: 142 bcm of gas, of which 100 bcm

Politics are keeping other countries in board was used by households for heat and cooking,

with Gazprom. Budapest is currently embroiled according to the foreign trade statistics office

in a row with the EU after it said that it would BAFA, which does not identify the origins of

concede to the Kremlin’s demand to rubles-on- imports. BAFA stopped publishing import vol-

ly-for-gas deal. Hungary plans to pay for Russian umes by country in 2016, because of new stricter

gas in euros through Gazprombank, which will privacy rules.

Week 15 15•April•2022 www. NEWSBASE .com P11