Page 38 - Noble's TMT Consumer Virtual Equity Conference 2024

P. 38

Information

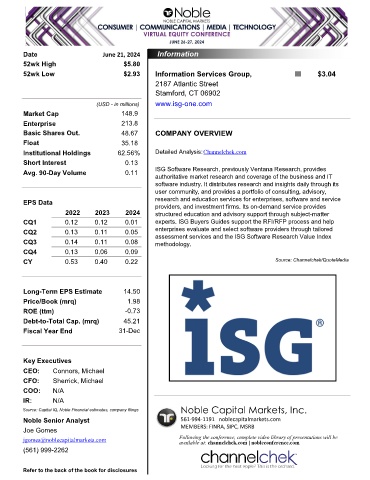

Date June 21, 2024 Information Technology

52wk High $5.80

52wk Low $2.93 Information Services Group, III $3.04

2187 Atlantic Street

Stamford, CT 06902

(USD - in millions) www.isg-one.com

Market Cap 148.9

Enterprise 213.8

Basic Shares Out. 48.67 COMPANY OVERVIEW

Float 35.18

Institutional Holdings 62.56% Detailed Analysis:Channelchek.com

Short Interest 0.13

Avg. 90-Day Volume 0.11 ISG Software Research, previously Ventana Research, provides

authoritative market research and coverage of the business and IT

software industry. It distributes research and insights daily through its

user community, and provides a portfolio of consulting, advisory,

EPS Data research and education services for enterprises, software and service

providers, and investment firms. Its on-demand service provides

2022 2023 2024 structured education and advisory support through subject-matter

CQ1 0.12 0.12 0.01 experts. ISG Buyers Guides support the RFI/RFP process and help

CQ2 0.13 0.11 0.05 enterprises evaluate and select software providers through tailored

assessment services and the ISG Software Research Value Index

CQ3 0.14 0.11 0.08 methodology.

CQ4 0.13 0.06 0.09

CY 0.53 0.40 0.22 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate 14.50

Price/Book (mrq) 1.98

ROE (ttm) -0.73

Debt-to-Total Cap. (mrq) 45.21

Fiscal Year End 31-Dec

2187 Atlantic SStamford CT 06902

Key Executives

CEO: Connors, Michael

CFO: Sherrick, Michael

COO: N/A

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Joe Gomes MEMBERS: FINRA, SIPC, MSRB

jgomes@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2262

Refer to the back of the book for disclosures