Page 11 - IMF-欧洲的金融科技:机遇与挑战(英文)-2020.11-35页.pdf

P. 11

10

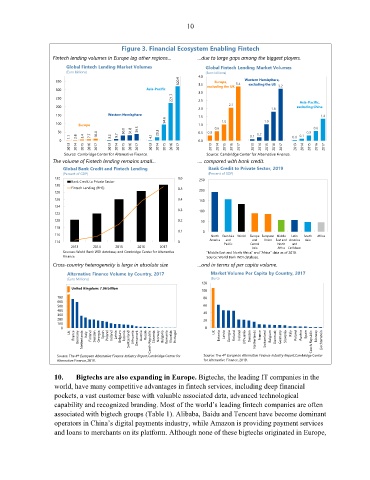

Figure 3. Financial Ecosystem Enabling Fintech

Fintech lending volumes in Europe lag other regions… …due to large gaps among the biggest players.

Global Fintech Lending Market Volumes Global Fintech Lending Market Volumes

(Euro billions) (Euro billions)

4.0

320.9 Western Hemisphere,

350 Europe, 3.4

3.5

excluding the UK excluding the US 3.2

300 Asia-Pacific

3.0

221.7

250 2.5

2.1 Asia-Pacific,

200 excluding China

2.0 1.8

150 Western Hemisphere 1.5 1.4

94.6 1.0 1.0

100 Europe 1.0 0.6 0.6

50 10.4 30.0 31.8 39.5 20.3 0.5 0.3 0.2 0.3

1.1 2.8 5.4 7.7 3.2 9.7 4.1 0.1 0.0 0.1

0 0.0

2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017

Source: Cambridge Center for Alternative Finance. Source: Cambridge Center for Alternative Finance.

The volume of Fintech lending remains small… …. compared with bank credit.

Global Bank Credit and Fintech Lending Bank Credit to Private Sector, 2019

(Percent of GDP) (Percent of GDP)

132 0.6

Bank Credit to Private Sector 250

130

Fintech Lending (RHS) 0.5

128 200

126 0.4 150

124

0.3 100

122

120 0.2 50

118

0.1 0

116 North East Asia World Europe European Middle Latin South Africa

114 0 America and and Union East and America Asia

Pacific Central North and

2013 2014 2015 2016 2017 Asia Africa Caribbean

Sources: World Bank WDI database; and Cambridge Center for Alternative "Middle East and North Africa" and "Africa" data as of 2018.

Finance. Source: World Bank WDI database.

Cross-country heterogeneity is large in absolute size …and in terms of per capita volume.

Alternative Finance Volume by Country, 2017 Market Volume Per Capita by Country, 2017

(Euro Millions) (Euro)

1000 120

900 United Kingdom: 7.06 billion 100

800

700 80

600

500 60

400

300 40

200 20

100

0 0

UK UK Italy

France Germany Netherlands Italy Finland Sweden Georgia Spain Poland Ireland Latvia Belgium Estonia Switzerland Lithuania Denamark Austria Russia Czech Republic Slovenia Norway Bulgaria Romania Slovakia Portugal Estonia Latvia Georgia Finland Ireland Lithuania Sweden Netherlands France Switzerland Belgium Denmark Germany Slovenia Poland Austria Spain Czech Republic Norway Liechtenstein

Source: The 4 th European Alternative Finance Industry Report,Cambridge Center for Source: The 4 th European Alternative Finance Industry Report,Cambridge Center

Alternative Finance, 2019. for Alternative Finance, 2019.

10. Bigtechs are also expanding in Europe. Bigtechs, the leading IT companies in the

world, have many competitive advantages in fintech services, including deep financial

pockets, a vast customer base with valuable associated data, advanced technological

capability and recognized branding. Most of the world’s leading fintech companies are often

associated with bigtech groups (Table 1). Alibaba, Baidu and Tencent have become dominant

operators in China’s digital payments industry, while Amazon is providing payment services

and loans to merchants on its platform. Although none of these bigtechs originated in Europe,