Page 6 - IMF-欧洲的金融科技:机遇与挑战(英文)-2020.11-35页.pdf

P. 6

6

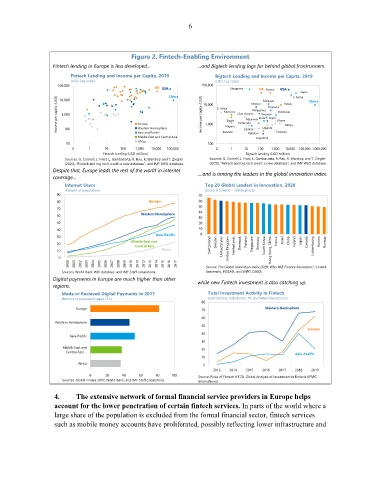

Figure 2. Fintech-Enabling Environment

Fintech lending in Europe is less developed... …and Bigtech lending lags far behind global frontrunners.

Fintech Lending and Income per Capita, 2019 Bigtech Lending and Income per Capita, 2019

(USD, log scale) (USD, log scale)

100,000 100,000

UK USA Singapore UK France USA

Japan China

China

Income per capita (USD) 1,000 Europe Income per capita (USD) 10,000 S. Africa Egypt Côte d'Ivoire Mexico India Thailand Ghana Russia

S. Korea

10,000

Malaysia

Philippines

Morocco

Indonesia

Vietnam

Brazil

Myanmar

Cambodia

1,000

Kenya

Nigeria

Uganda

Western Hemisphere

100

Asia and Pacific

Pakistan

Middle East and Central Asia Rwanda Zambia Argentina Tanzania

Africa

10 100

0 1 10 100 1,000 10,000 100,000 0 1 10 100 1,000 10,000 100,000 1,000,000

Fintech lending (USD million) Bigtech lending (USD million)

Sources: G. Cornelli, J. Frost, L. Gambacorta, R. Rau, R. Wardrop and T. Ziegler Sources: G. Cornelli, J. Frost, L. Gambacorta, R. Rau, R. Wardrop and T. Ziegler

(2020), "Fintech and big tech credit: a new database"; and IMF WEO database. (2020), "Fintech and big tech credit: a new database"; and IMF WEO database.

Despite that, Europe leads the rest of the world in internet

coverage… ….and is among the leaders in the global innovation index.

Internet Users Top 20 Global Leaders in Innovation, 2020

(Percent of population) (Score: 0 (lowest) - 100 (highest))

90 70

80 Europe 60

50

70

40

Western Hemisphere

60

30

50 20

40 10

Asia-Pacific 0

30

Middle East and Finland France Israel China Ireland Japan Austria

20 Switzerland Sweden Denmark Singapore Germany Canada Norway

Central Asia United States Netherlands South Korea Luxembourg

10 Africa United Kingdom Hong Kong, China

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: The Global Innovation Index 2020: Who Will Finance Innovation?, Cornell

Sources: World Bank WDI database; and IMF Staff calculations. University, INSEAD, and WIPO (2020).

Digital payments in Europe are much higher than other

while new Fintech investment is also catching up.

regions.

Made or Recieved Digital Payments in 2017 Total Investment Activity in Fintech

(Percent of population aged 15+) (USD billions, includes VC, PE and M&A transactions)

80

Europe 70 Western Hemisphere

60

Western Hemisphere

50

Europe

40

Asia-Pacific

30

Middle East and 20

Central Asia

Asia-Pacific

10

Africa 0

2013 2014 2015 2016 2017 2018 2019

0 20 40 60 80 100

Source: Pulse of Fintech H1'20, Global Analysis of Investment in Fintech, KPMG

Sources: Global Findex 2017, World Bank; and IMF Staff calculations.

International.

4. The extensive network of formal financial service providers in Europe helps

account for the lower penetration of certain fintech services. In parts of the world where a

large share of the population is excluded from the formal financial sector, fintech services

such as mobile money accounts have proliferated, possibly reflecting lower infrastructure and