Page 22 - chfa2015CommRpt

P. 22

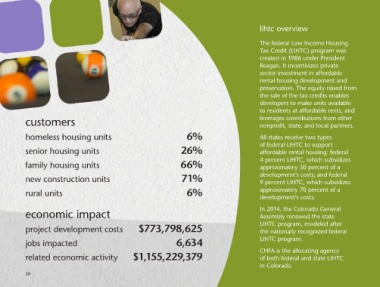

customers 6% lihtc overview

26%

homeless housing units 66% The federal Low Income Housing

senior housing units 71% Tax Credit (LIHTC) program was

family housing units created in 1986 under President

new construction units 6% Reagan. It incentivizes private

rural units sector investment in affordable

rental housing development and

economic impact preservation. The equity raised from

the sale of the tax credits enables

project development costs $773,798,625 developers to make units available

to residents at affordable rents, and

jobs impacted 6,634 leverages contributions from other

nonprofit, state, and local partners.

related economic activity $1,155,229,379

All states receive two types

of federal LIHTC to support

affordable rental housing: federal

4 percent LIHTC, which subsidizes

approximately 30 percent of a

development’s costs; and federal

9 percent LIHTC, which subsidizes

approximately 70 percent of a

development’s costs.

In 2014, the Colorado General

Assembly renewed the state

LIHTC program, modeled after

the nationally recognized federal

LIHTC program.

CHFA is the allocating agency

of both federal and state LIHTC

in Colorado.

19