Page 23 - chfa2015CommRpt

P. 23

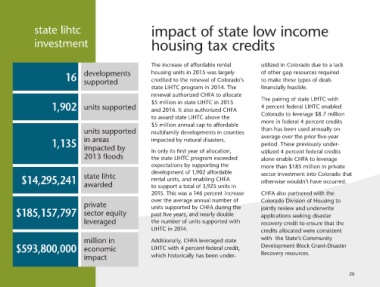

state lihtc impact of state low income

investment housing tax credits

16 developments The increase of affordable rental utilized in Colorado due to a lack

supported housing units in 2015 was largely of other gap resources required

credited to the renewal of Colorado’s to make these types of deals

1,902 units supported state LIHTC program in 2014. The financially feasible.

renewal authorized CHFA to allocate

1,135 units supported $5 million in state LIHTC in 2015 The pairing of state LIHTC with

in areas and 2016. It also authorized CHFA 4 percent federal LIHTC enabled

impacted by to award state LIHTC above the Colorado to leverage $8.7 million

2013 floods $5 million annual cap to affordable more in federal 4 percent credits

multifamily developments in counties than has been used annually on

$14,295,241 state lihtc impacted by natural disasters. average over the prior five-year

awarded period. These previously under-

In only its first year of allocation, utilized 4 percent federal credits

$185,157,797 private the state LIHTC program exceeded alone enable CHFA to leverage

sector equity expectations by supporting the more than $185 million in private

leveraged development of 1,902 affordable sector investment into Colorado that

rental units, and enabling CHFA otherwise wouldn’t have occurred.

$593,800,000 million in to support a total of 3,925 units in

economic 2015. This was a 146 percent increase CHFA also partnered with the

impact over the average annual number of Colorado Division of Housing to

units supported by CHFA during the jointly review and underwrite

past five years, and nearly double applications seeking disaster

the number of units supported with recovery credit to ensure that the

LIHTC in 2014. credits allocated were consistent

with the State’s Community

Additionally, CHFA leveraged state Development Block Grant-Disaster

LIHTC with 4 percent federal credit, Recovery resources.

which historically has been under-

20