Page 152 - Accounting Principles (A Business Perspective)

P. 152

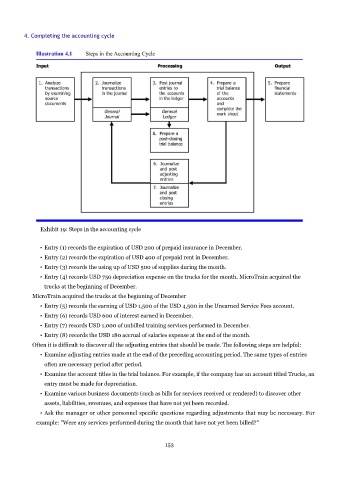

4. Completing the accounting cycle

Exhibit 19: Steps in the accounting cycle

• Entry (1) records the expiration of USD 200 of prepaid insurance in December.

• Entry (2) records the expiration of USD 400 of prepaid rent in December.

• Entry (3) records the using up of USD 500 of supplies during the month.

• Entry (4) records USD 750 depreciation expense on the trucks for the month. MicroTrain acquired the

trucks at the beginning of December.

MicroTrain acquired the trucks at the beginning of December

• Entry (5) records the earning of USD 1,500 of the USD 4,500 in the Unearned Service Fees account.

• Entry (6) records USD 600 of interest earned in December.

• Entry (7) records USD 1,000 of unbilled training services performed in December.

• Entry (8) records the USD 180 accrual of salaries expense at the end of the month.

Often it is difficult to discover all the adjusting entries that should be made. The following steps are helpful:

• Examine adjusting entries made at the end of the preceding accounting period. The same types of entries

often are necessary period after period.

• Examine the account titles in the trial balance. For example, if the company has an account titled Trucks, an

entry must be made for depreciation.

• Examine various business documents (such as bills for services received or rendered) to discover other

assets, liabilities, revenues, and expenses that have not yet been recorded.

• Ask the manager or other personnel specific questions regarding adjustments that may be necessary. For

example: "Were any services performed during the month that have not yet been billed?"

153