Page 260 - Accounting Principles (A Business Perspective)

P. 260

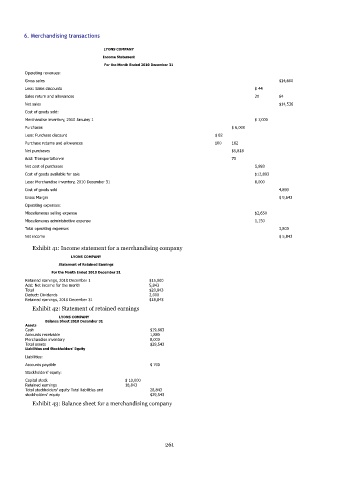

6. Merchandising transactions

LYONS COMPANY

Income Statement

For the Month Ended 2010 December 31

Operating revenues:

Gross sales $14,600

Less: Sales discounts $ 44

Sales return and allowances 20 64

Net sales $14,536

Cost of goods sold:

Merchandise inventory, 2010 January 1 $ 7,000

Purchases $ 6,000

Less: Purchase discount $ 82

Purchase returns and allowances 100 182

Net purchases $5,818

Add: Transportation-in 75

Net cost of purchases 5,893

Cost of goods available for sale $12,893

Less: Merchandise inventory, 2010 December 31 8,000

Cost of goods sold 4,893

Gross Margin $ 9,643

Operating expenses:

Miscellaneous selling expense $2,650

Miscellaneous administrative expense 1,150

Total operating expenses 3,800

Net income $ 5,843

Exhibit 41: Income statement for a merchandising company

LYONS COMPANY

Statement of Retained Earnings

For the Month Ended 2010 December 31

Retained earnings, 2010 December 1 $15,000

Add: Net income for the month 5,843

Total $20,843

Deduct: Dividends 2,000

Retained earnings, 2010 December 31 $18,843

Exhibit 42: Statement of retained earnings

LYONS COMPANY

Balance Sheet 2010 December 31

Assets

Cash $19,663

Accounts receivable 1,880

Merchandise inventory 8,000

Total assets $29,543

Liabilities and Stockholders' Equity

Liabilities:

Accounts payable $ 700

Stockholders' equity:

Capital stock $ 10,000

Retained earnings 18,843

Total stockholders' equity Total liabilities and 28,843

stockholders' equity $29,543

Exhibit 43: Balance sheet for a merchandising company

261