Page 263 - Accounting Principles (A Business Perspective)

P. 263

This book is licensed under a Creative Commons Attribution 3.0 License

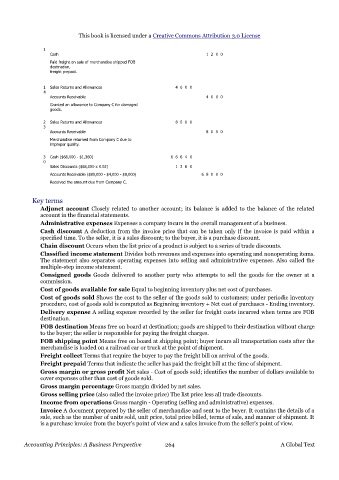

1

Cash 1 2 0 0

Paid freight on sale of merchandise shipped FOB

destination,

freight prepaid.

1 Sales Returns and Allowances 4 0 0 0

4

Accounts Receivable 4 0 0 0

Granted an allowance to Company C for damaged

goods.

2 Sales Returns and Allowances 8 0 0 0

3

Accounts Receivable 8 0 0 0

Merchandise returned from Company C due to

improper quality.

3 Cash ($68,000 - $1,360) 6 6 6 4 0

0

Sales Discounts ($68,000 x 0.02) 1 3 6 0

Accounts Receivable ($80,000 - $4,000 - $8,000) 6 8 0 0 0

Received the amount due from Company C.

Key terms

Adjunct account Closely related to another account; its balance is added to the balance of the related

account in the financial statements.

Administrative expenses Expenses a company incurs in the overall management of a business.

Cash discount A deduction from the invoice price that can be taken only if the invoice is paid within a

specified time. To the seller, it is a sales discount; to the buyer, it is a purchase discount.

Chain discount Occurs when the list price of a product is subject to a series of trade discounts.

Classified income statement Divides both revenues and expenses into operating and nonoperating items.

The statement also separates operating expenses into selling and administrative expenses. Also called the

multiple-step income statement.

Consigned goods Goods delivered to another party who attempts to sell the goods for the owner at a

commission.

Cost of goods available for sale Equal to beginning inventory plus net cost of purchases.

Cost of goods sold Shows the cost to the seller of the goods sold to customers; under periodic inventory

procedure, cost of goods sold is computed as Beginning inventory + Net cost of purchases - Ending inventory.

Delivery expense A selling expense recorded by the seller for freight costs incurred when terms are FOB

destination.

FOB destination Means free on board at destination; goods are shipped to their destination without charge

to the buyer; the seller is responsible for paying the freight charges.

FOB shipping point Means free on board at shipping point; buyer incurs all transportation costs after the

merchandise is loaded on a railroad car or truck at the point of shipment.

Freight collect Terms that require the buyer to pay the freight bill on arrival of the goods.

Freight prepaid Terms that indicate the seller has paid the freight bill at the time of shipment.

Gross margin or gross profit Net sales - Cost of goods sold; identifies the number of dollars available to

cover expenses other than cost of goods sold.

Gross margin percentage Gross margin divided by net sales.

Gross selling price (also called the invoice price) The list price less all trade discounts.

Income from operations Gross margin - Operating (selling and administrative) expenses.

Invoice A document prepared by the seller of merchandise and sent to the buyer. It contains the details of a

sale, such as the number of units sold, unit price, total price billed, terms of sale, and manner of shipment. It

is a purchase invoice from the buyer's point of view and a sales invoice from the seller's point of view.

Accounting Principles: A Business Perspective 264 A Global Text