Page 261 - Accounting Principles (A Business Perspective)

P. 261

This book is licensed under a Creative Commons Attribution 3.0 License

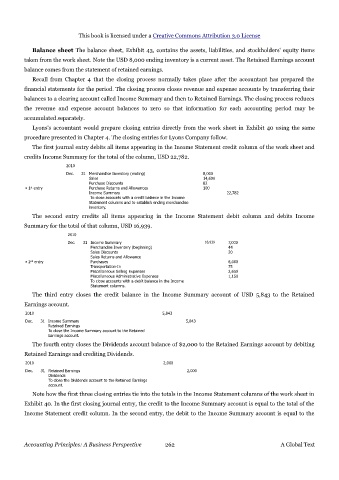

Balance sheet The balance sheet, Exhibit 43, contains the assets, liabilities, and stockholders' equity items

taken from the work sheet. Note the USD 8,000 ending inventory is a current asset. The Retained Earnings account

balance comes from the statement of retained earnings.

Recall from Chapter 4 that the closing process normally takes place after the accountant has prepared the

financial statements for the period. The closing process closes revenue and expense accounts by transferring their

balances to a clearing account called Income Summary and then to Retained Earnings. The closing process reduces

the revenue and expense account balances to zero so that information for each accounting period may be

accumulated separately.

Lyons's accountant would prepare closing entries directly from the work sheet in Exhibit 40 using the same

procedure presented in Chapter 4. The closing entries for Lyons Company follow.

The first journal entry debits all items appearing in the Income Statement credit column of the work sheet and

credits Income Summary for the total of the column, USD 22,782.

2010

Dec. 31 Merchandise Inventory (ending) 8,000

Sales 14,600

Purchase Discounts 82

• 1 entry Purchase Returns and Allowances 100

st

Income Summary 22,782

To close accounts with a credit balance in the Income

Statement columns and to establish ending merchandise

inventory.

The second entry credits all items appearing in the Income Statement debit column and debits Income

Summary for the total of that column, USD 16,939.

2010

Dec. 31 Income Summary 16,939 7,000

Merchandise Inventory (beginning) 44

Sales Discounts 20

Sales Returns and Allowance

• 2 entry Purchases 6,000

nd

Transportation-In 75

Miscellaneous Selling Expenses 2,650

Miscellaneous Administrative Expenses 1,150

To close accounts with a debit balance in the Income

Statement columns.

The third entry closes the credit balance in the Income Summary account of USD 5,843 to the Retained

Earnings account.

2010 5,843

Dec. 31 Income Summary 5,843

Retained Earnings

To close the Income Summary account to the Retained

Earnings account.

The fourth entry closes the Dividends account balance of $2,000 to the Retained Earnings account by debiting

Retained Earnings and crediting Dividends.

2010 2,000

Dec. 31 Retained Earnings 2,000

Dividends

To close the Dividends account to the Retained Earnings

account.

Note how the first three closing entries tie into the totals in the Income Statement columns of the work sheet in

Exhibit 40. In the first closing journal entry, the credit to the Income Summary account is equal to the total of the

Income Statement credit column. In the second entry, the debit to the Income Summary account is equal to the

Accounting Principles: A Business Perspective 262 A Global Text