Page 313 - Accounting Principles (A Business Perspective)

P. 313

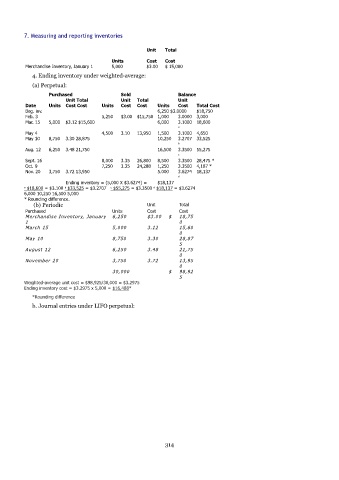

7. Measuring and reporting inventories

Unit Total

Units Cost Cost

Merchandise Inventory, January 1 5,000 $3.00 $ 15,000

4. Ending inventory under weighted-average:

(a) Perpetual:

Purchased Sold Balance

Unit Total Unit Total Unit

Date Units Cost Cost Units Cost Cost Units Cost Total Cost

Beg. inv. 6,250 $3.0000 $18,750

Feb. 3 5,250 $3.00 $15,750 1,000 3.0000 3,000

Mar. 15 5,000 $3.12 $15,600 6,000 3.1000 18,600

a

May 4 4,500 3.10 13,950 1,500 3.1000 4,650

May 10 8,750 3.30 28,875 10,250 3.2707 33,525

b

Aug. 12 6,250 3.48 21,750 16,500 3.3500 55,275

c

Sept. 16 8,000 3.35 26,800 8,500 3.3500 28,475 *

Oct. 9 7,250 3.35 24,288 1,250 3.3500 4,187 *

Nov. 20 3,750 3.72 13,950 5.000 3.6274 18,137

d

Ending inventory = (5,000 X $3.6274) = $18,137

$18,600 a = $3.100 $33,525 = $3.2707 $55,275 = $3.3500 $18,137 = $3.6274

b

d

c

6,000 10,250 16,500 5,000

* Rounding difference.

(b) Periodic Unit Total

Purchased Units Cost Cost

Merchandise Inventory, January 6,250 $3.00 $ 18,75

1 0

March 15 5,000 3.12 15,60

0

May 10 8,750 3.30 28,87

5

August 12 6,250 3.48 21,75

0

November 20 3,750 3.72 13,95

0

30,000 $ 98,92

5

Weighted-average unit cost = $98,925/30,000 = $3.2975

Ending inventory cost = $3.2975 x 5,000 = $16,488*

*Rounding difference

b. Journal entries under LIFO perpetual:

314