Page 315 - Accounting Principles (A Business Perspective)

P. 315

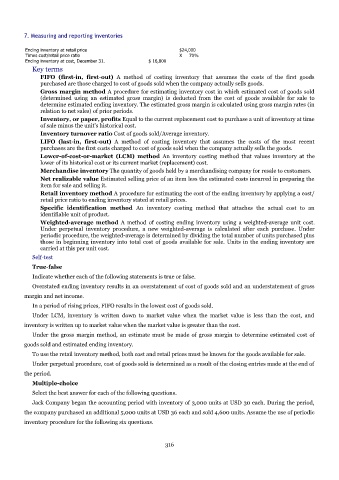

7. Measuring and reporting inventories

Ending inventory at retail price $24,000

Times cost/retail price ratio X 70%

Ending inventory at cost, December 31. $ 16,800

Key terms

FIFO (first-in, first-out) A method of costing inventory that assumes the costs of the first goods

purchased are those charged to cost of goods sold when the company actually sells goods.

Gross margin method A procedure for estimating inventory cost in which estimated cost of goods sold

(determined using an estimated gross margin) is deducted from the cost of goods available for sale to

determine estimated ending inventory. The estimated gross margin is calculated using gross margin rates (in

relation to net sales) of prior periods.

Inventory, or paper, profits Equal to the current replacement cost to purchase a unit of inventory at time

of sale minus the unit's historical cost.

Inventory turnover ratio Cost of goods sold/Average inventory.

LIFO (last-in, first-out) A method of costing inventory that assumes the costs of the most recent

purchases are the first costs charged to cost of goods sold when the company actually sells the goods.

Lower-of-cost-or-market (LCM) method An inventory costing method that values inventory at the

lower of its historical cost or its current market (replacement) cost.

Merchandise inventory The quantity of goods held by a merchandising company for resale to customers.

Net realizable value Estimated selling price of an item less the estimated costs incurred in preparing the

item for sale and selling it.

Retail inventory method A procedure for estimating the cost of the ending inventory by applying a cost/

retail price ratio to ending inventory stated at retail prices.

Specific identification method An inventory costing method that attaches the actual cost to an

identifiable unit of product.

Weighted-average method A method of costing ending inventory using a weighted-average unit cost.

Under perpetual inventory procedure, a new weighted-average is calculated after each purchase. Under

periodic procedure, the weighted-average is determined by dividing the total number of units purchased plus

those in beginning inventory into total cost of goods available for sale. Units in the ending inventory are

carried at this per unit cost.

Self-test

True-false

Indicate whether each of the following statements is true or false.

Overstated ending inventory results in an overstatement of cost of goods sold and an understatement of gross

margin and net income.

In a period of rising prices, FIFO results in the lowest cost of goods sold.

Under LCM, inventory is written down to market value when the market value is less than the cost, and

inventory is written up to market value when the market value is greater than the cost.

Under the gross margin method, an estimate must be made of gross margin to determine estimated cost of

goods sold and estimated ending inventory.

To use the retail inventory method, both cost and retail prices must be known for the goods available for sale.

Under perpetual procedure, cost of goods sold is determined as a result of the closing entries made at the end of

the period.

Multiple-choice

Select the best answer for each of the following questions.

Jack Company began the accounting period with inventory of 3,000 units at USD 30 each. During the period,

the company purchased an additional 5,000 units at USD 36 each and sold 4,600 units. Assume the use of periodic

inventory procedure for the following six questions.

316