Page 330 - Accounting Principles (A Business Perspective)

P. 330

7. Measuring and reporting inventories

Determine the kinds of information that can be obtained at this site. Specifically, what kinds of products and

services are available? What is the background of Lexis-Nexis? What pricing information is available for using its

services? Write a report to your instructor summarizing your findings.

Answers to self-test

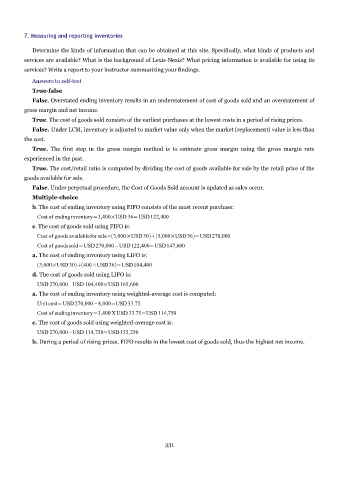

True-false

False. Overstated ending inventory results in an understatement of cost of goods sold and an overstatement of

gross margin and net income.

True. The cost of goods sold consists of the earliest purchases at the lowest costs in a period of rising prices.

False. Under LCM, inventory is adjusted to market value only when the market (replacement) value is less than

the cost.

True. The first step in the gross margin method is to estimate gross margin using the gross margin rate

experienced in the past.

True. The cost/retail ratio is computed by dividing the cost of goods available for sale by the retail price of the

goods available for sale.

False. Under perpetual procedure, the Cost of Goods Sold account is updated as sales occur.

Multiple-choice

b. The cost of ending inventory using FIFO consists of the most recent purchase:

Cost of endinginventory=3,400×USD 36=USD122,400

c. The cost of goods sold using FIFO is:

Cost of goods availablefor sale=3,000×USD305,000×USD36=USD270,000

Cost of goodssold=USD270,000 – USD122,400=USD147,600

a. The cost of ending inventory using LIFO is:

3,000×USD 30400×USD36=USD104,400

d. The cost of goods sold using LIFO is:

USD 270,000 – USD 104,400=USD165,600

a. The cost of ending inventory using weighted-average cost is computed:

Unit cost=USD270,000−8,000=USD33.75

Cost of endinginventory=3,400 X USD33.75=USD114,750

c. The cost of goods sold using weighted-average cost is:

USD 270,000 – USD 114,750=USD155,250

b. During a period of rising prices, FIFO results in the lowest cost of goods sold, thus the highest net income.

331