Page 335 - Accounting Principles (A Business Perspective)

P. 335

This book is licensed under a Creative Commons Attribution 3.0 License

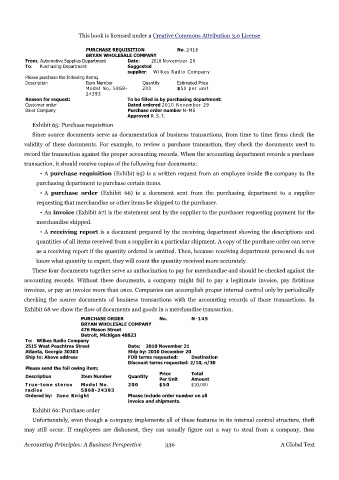

PURCHASE REQUISITION No. 2416

BRYAN WHOLESALE COMPANY

From; Automotive Supplies Department Date: 2010 November 20

To: Purchasing Department Suggested

supplier: Wilkes Radio Company

Please purchase the following items;

Description Item Number Quantity Estimated Price

Model No. 5868- 200 $50 per unit

24393

Reason for request: To be filled in by purchasing department:

Customer order Dated ordered 2010 November 29

Baier Company Purchase order number N-MS

Approved R.S.T.

Exhibit 65: Purchase requisition

Since source documents serve as documentation of business transactions, from time to time firms check the

validity of these documents. For example, to review a purchase transaction, they check the documents used to

record the transaction against the proper accounting records. When the accounting department records a purchase

transaction, it should receive copies of the following four documents:

• A purchase requisition (Exhibit 65) is a written request from an employee inside the company to the

purchasing department to purchase certain items.

• A purchase order (Exhibit 66) is a document sent from the purchasing department to a supplier

requesting that merchandise or other items be shipped to the purchaser.

• An invoice (Exhibit 67) is the statement sent by the supplier to the purchaser requesting payment for the

merchandise shipped.

• A receiving report is a document prepared by the receiving department showing the descriptions and

quantities of all items received from a supplier in a particular shipment. A copy of the purchase order can serve

as a receiving report if the quantity ordered is omitted. Then, because receiving department personnel do not

know what quantity to expect, they will count the quantity received more accurately.

These four documents together serve as authorization to pay for merchandise and should be checked against the

accounting records. Without these documents, a company might fail to pay a legitimate invoice, pay fictitious

invoices, or pay an invoice more than once. Companies can accomplish proper internal control only by periodically

checking the source documents of business transactions with the accounting records of those transactions. In

Exhibit 68 we show the flow of documents and goods in a merchandise transaction.

PURCHASE ORDER No. N-145

BRYAN WHOLESALE COMPANY

476 Mason Street

Detroit, Michigan 48823

To: Wilkes Radio Company

2515 West Peachtree Street Date: 2010 November 21

Atlanta, Georgia 30303 Ship by: 2010 December 20

Ship to: Above address FOB terms requested: Destination

Discount terms requested: 2/10, n/30

Please send the foil owing item;

Price Total

Description Item Number Quantity

Per Unit Amount

True-tone stereo Model No. 200 $50 $10,000

radios 5868-24393

Ordered by: Jane Knight Please include order number on all

invoice and shipments.

Exhibit 66: Purchase order

Unfortunately, even though a company implements all of these features in its internal control structure, theft

may still occur. If employees are dishonest, they can usually figure out a way to steal from a company, thus

Accounting Principles: A Business Perspective 336 A Global Text