Page 350 - Accounting Principles (A Business Perspective)

P. 350

8. Control of cash

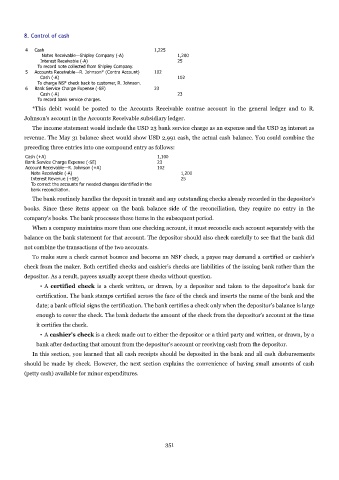

4 Cash 1,225

Notes Receivable—Shipley Company (-A) 1,200

Interest Receivable (-A) 25

To record note collected from Shipley Company.

5 Accounts Receivable—R. Johnson* (Contra Account) 102

Cash (-A) 102

To charge NSF check back to customer, R. Johnson.

6 Bank Service Charge Expense (-SE) 23

Cash (-A) 23

To record bank service charges.

*This debit would be posted to the Accounts Receivable contrae account in the general ledger and to R.

Johnson's account in the Accounts Receivable subsidiary ledger.

The income statement would include the USD 23 bank service charge as an expense and the USD 25 interest as

revenue. The May 31 balance sheet would show USD 2,991 cash, the actual cash balance. You could combine the

preceding three entries into one compound entry as follows:

Cash (+A) 1,100

Bank Service Charge Expense (-SE) 23

Account Receivable—R. Johnson (+A) 102

Note Receivable (-A) 1,200

Interest Revenue (+SE) 25

To correct the accounts for needed changes identified in the

bank reconciliation.

The bank routinely handles the deposit in transit and any outstanding checks already recorded in the depositor's

books. Since these items appear on the bank balance side of the reconciliation, they require no entry in the

company's books. The bank processes these items in the subsequent period.

When a company maintains more than one checking account, it must reconcile each account separately with the

balance on the bank statement for that account. The depositor should also check carefully to see that the bank did

not combine the transactions of the two accounts.

To make sure a check cannot bounce and become an NSF check, a payee may demand a certified or cashier's

check from the maker. Both certified checks and cashier's checks are liabilities of the issuing bank rather than the

depositor. As a result, payees usually accept these checks without question.

• A certified check is a check written, or drawn, by a depositor and taken to the depositor's bank for

certification. The bank stamps certified across the face of the check and inserts the name of the bank and the

date; a bank official signs the certification. The bank certifies a check only when the depositor's balance is large

enough to cover the check. The bank deducts the amount of the check from the depositor's account at the time

it certifies the check.

• A cashier's check is a check made out to either the depositor or a third party and written, or drawn, by a

bank after deducting that amount from the depositor's account or receiving cash from the depositor.

In this section, you learned that all cash receipts should be deposited in the bank and all cash disbursements

should be made by check. However, the next section explains the convenience of having small amounts of cash

(petty cash) available for minor expenditures.

351