Page 345 - Accounting Principles (A Business Perspective)

P. 345

This book is licensed under a Creative Commons Attribution 3.0 License

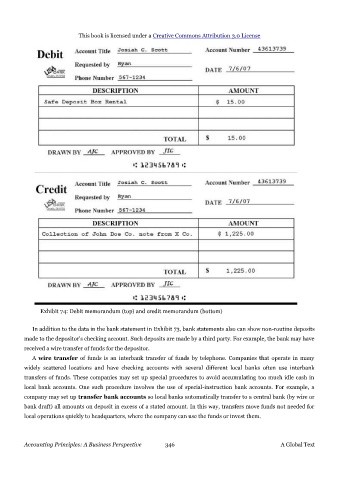

Exhibit 74: Debit memorandum (top) and credit memorandum (bottom)

In addition to the data in the bank statement in Exhibit 73, bank statements also can show non-routine deposits

made to the depositor's checking account. Such deposits are made by a third party. For example, the bank may have

received a wire transfer of funds for the depositor.

A wire transfer of funds is an interbank transfer of funds by telephone. Companies that operate in many

widely scattered locations and have checking accounts with several different local banks often use interbank

transfers of funds. These companies may set up special procedures to avoid accumulating too much idle cash in

local bank accounts. One such procedure involves the use of special-instruction bank accounts. For example, a

company may set up transfer bank accounts so local banks automatically transfer to a central bank (by wire or

bank draft) all amounts on deposit in excess of a stated amount. In this way, transfers move funds not needed for

local operations quickly to headquarters, where the company can use the funds or invest them.

Accounting Principles: A Business Perspective 346 A Global Text