Page 349 - Accounting Principles (A Business Perspective)

P. 349

This book is licensed under a Creative Commons Attribution 3.0 License

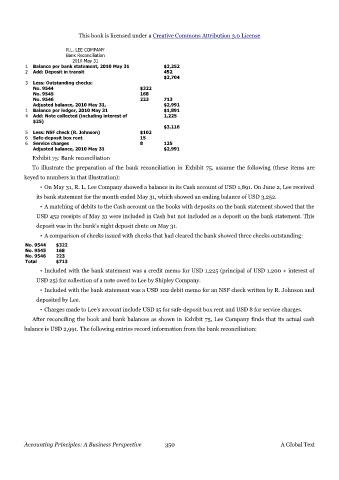

R.L. LEE COMPANY

Bank Reconciliation

2010 May 31

1 Balance per bank statement, 2010 May 31 $3,252

2 Add: Deposit in transit 452

$3,704

3 Less: Outstanding checks:

No. 9544 $322

No. 9545 168

No. 9546 223 713

Adjusted balance, 2010 May 31, $2,991

1 Balance per ledger, 2010 May 31 $1,891

4 Add: Note collected (including interest of 1,225

$25)

$3,116

5 Less: NSF check (R. Johnson) $102

6 Safe-deposit box rent 15

6 Service charges 8 125

Adjusted balance, 2010 May 31 $2,991

Exhibit 75: Bank reconciliation

To illustrate the preparation of the bank reconciliation in Exhibit 75, assume the following (these items are

keyed to numbers in that illustration):

• On May 31, R. L. Lee Company showed a balance in its Cash account of USD 1,891. On June 2, Lee received

its bank statement for the month ended May 31, which showed an ending balance of USD 3,252.

• A matching of debits to the Cash account on the books with deposits on the bank statement showed that the

USD 452 receipts of May 31 were included in Cash but not included as a deposit on the bank statement. This

deposit was in the bank's night deposit chute on May 31.

• A comparison of checks issued with checks that had cleared the bank showed three checks outstanding:

No. 9544 $322

No. 9545 168

No. 9546 223

Total $713

• Included with the bank statement was a credit memo for USD 1,225 (principal of USD 1,200 + interest of

USD 25) for collection of a note owed to Lee by Shipley Company.

• Included with the bank statement was a USD 102 debit memo for an NSF check written by R. Johnson and

deposited by Lee.

• Charges made to Lee's account include USD 15 for safe-deposit box rent and USD 8 for service charges.

After reconciling the book and bank balances as shown in Exhibit 75, Lee Company finds that its actual cash

balance is USD 2,991. The following entries record information from the bank reconciliation:

Accounting Principles: A Business Perspective 350 A Global Text