Page 690 - Accounting Principles (A Business Perspective)

P. 690

This book is licensed under a Creative Commons Attribution 3.0 License

Rate of return on operating assets The best measure of earnings performance without regard to the

sources of assets is the relationship of net operating income to operating assets, the rate of return on operating

assets. This ratio shows the earning power of the company as a bundle of assets. By disregarding both

nonoperating assets and nonoperating income elements, the rate of return on operating assets measures the

profitability of the company in carrying out its primary business functions. We can break the ratio down into two

elements—the operating margin and the turnover of operating assets.

Operating margin reflects the percentage of each dollar of net sales that becomes net operating income. Net

operating income excludes nonoperating income elements such as extraordinary items, cumulative effect on

prior years of changes in accounting principle, losses or gains from discontinued operations, interest revenue, and

interest expense. Another name for net operating income is "income before interest and taxes" (IBIT). The

formula for operating margin is:

Net operatingincome

Operating margin=

Net sales

Turnover of operating assets shows the amount of sales dollars generated for each dollar invested in

operating assets. Operating assets are all assets actively used in producing operating revenues. Typically, we use

year-end operating assets, even though in theory an average would be better. Nonoperating assets are owned by

a company but not used in producing operating revenues, such as land held for future use, a factory building rented

to another company, and long-term bond investments. Analysts do not use these nonoperating assets in evaluating

earnings performance. Nor do they use total assets that include nonoperating assets not contributing to the

generation of sales. The formula for the turnover of operating assets is:

Netsales

Turnover of operatingassets=

Operatingassets

The rate of return on operating assets of a company is equal to its operating margin multiplied by turnover of

operating assets. The more a company earns per dollar of sales and the more sales it makes per dollar invested in

operating assets, the higher is the return per dollar invested. To find the rate of return on operating assets, use the

following formulas:

Operating margin×Turnover of operatingassets=Rate of return onoperatingassets

or

Net operatingincome Netsales

Rate of return onoperatingassets= ×

Netsales Operatingassets

Because net sales appears in both ratios (once as a numerator and once as a denominator), we can cancel it out,

and the formula for rate of return on operating assets becomes:

Net operatingincome

Rate of return onoperatingassets=

Operatingassets

For analytical purposes, the formula should remain in the form that shows margin and turnover separately,

since it provides more information.

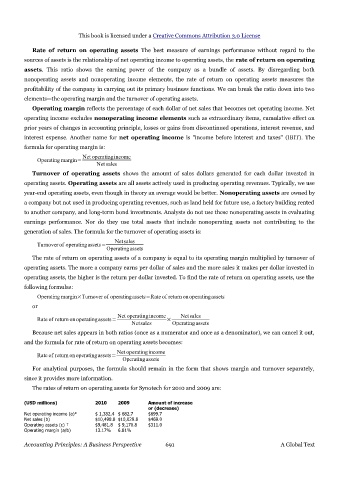

The rates of return on operating assets for Synotech for 2010 and 2009 are:

(USD millions) 2010 2009 Amount of increase

or (decrease)

Net operating income (a)* $ 1,382.4 $ 682.7 $699.7

Net sales (b) $10,498.8 $10,029.8 $469.0

Operating assets (c) † $9,481.8 $ 9,170.8 $311.0

Operating margin (a/b) 13.17% 6.81%

Accounting Principles: A Business Perspective 691 A Global Text