Page 692 - Accounting Principles (A Business Perspective)

P. 692

This book is licensed under a Creative Commons Attribution 3.0 License

assets as a measure of management's efficient use of assets, they are even more interested in the return the

company earns on each dollar of stockholders' equity. The formula for return on average common stockholders'

equity if no preferred stock is outstanding is:

Net income

Return onaveragecommon stockholders'equity=

Averagecommon stockholders'equity

When a company has preferred stock outstanding, the numerator of this ratio becomes net income minus the

annual preferred dividends, and the denominator becomes the average book value of common stock. As described

in Chapter 12, the book value of common stock is equal to total stockholders' equity minus (1) the liquidation value

(usually equal to par value) of preferred stock and (2) any dividends in arrears on cumulative preferred stock. Thus,

the formula becomes:

Net income−Preferredstock dividends

Return onaveragecommon stockholders'equity=

Average book value of commonstock

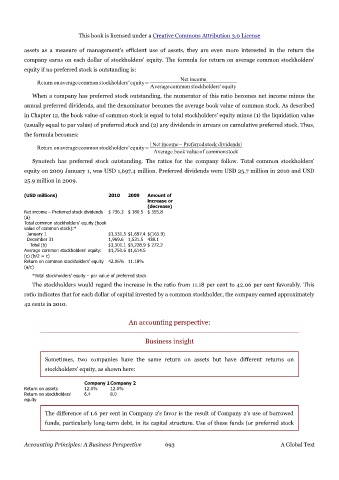

Synotech has preferred stock outstanding. The ratios for the company follow. Total common stockholders'

equity on 2009 January 1, was USD 1,697.4 million. Preferred dividends were USD 25.7 million in 2010 and USD

25.9 million in 2009.

(USD millions) 2010 2009 Amount of

increase or

(decrease)

Net income – Preferred stock dividends $ 736.3 $ 180.5 $ 555.8

(a)

Total common stockholders' equity (book

value of common stock):*

January 1 $1,531.5 $1,697.4 $(165.9)

December 31 1,969.6 1,531.5 438.1

Total (b) $3,501.1 $3,228.9 $ 272.2

Average common stockholders' equity: $1,750.6 $1,614.5

(c) (b/2 = c)

Return on common stockholders' equity 42.06% 11.18%

(a/c)

*Total stockholders' equity – par value of preferred stock

The stockholders would regard the increase in the ratio from 11.18 per cent to 42.06 per cent favorably. This

ratio indicates that for each dollar of capital invested by a common stockholder, the company earned approximately

42 cents in 2010.

An accounting perspective:

Business insight

Sometimes, two companies have the same return on assets but have different returns on

stockholders' equity, as shown here:

Company 1Company 2

Return on assets 12.0% 12.0%

Return on stockholders' 6.4 8.0

equity

The difference of 1.6 per cent in Company 2's favor is the result of Company 2's use of borrowed

funds, particularly long-term debt, in its capital structure. Use of these funds (or preferred stock

Accounting Principles: A Business Perspective 693 A Global Text