Page 10 - Watermark_Offering Memorandum_GSP

P. 10

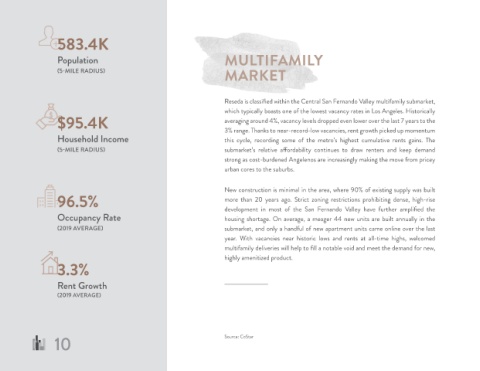

583.4K

Population MULTIFAMILY

MARKET

(5-MILE RADIUS)

Reseda is classified within the Central San Fernando Valley multifamily submarket,

which typically boasts one of the lowest vacancy rates in Los Angeles. Historically

$95.4K averaging around 4%, vacancy levels dropped even lower over the last 7 years to the

3% range. Thanks to near-record-low vacancies, rent growth picked up momentum

Household Income this cycle, recording some of the metro’s highest cumulative rents gains. The

(5-MILE RADIUS) submarket’s relative affordability continues to draw renters and keep demand

strong as cost-burdened Angelenos are increasingly making the move from pricey

urban cores to the suburbs.

New construction is minimal in the area, where 90% of existing supply was built

96.5% more than 20 years ago. Strict zoning restrictions prohibiting dense, high-rise

development in most of the San Fernando Valley have further amplified the

Occupancy Rate housing shortage. On average, a meager 44 new units are built annually in the

(2019 AVERAGE) submarket, and only a handful of new apartment units came online over the last

year. With vacancies near historic lows and rents at all-time highs, welcomed

multifamily deliveries will help to fill a notable void and meet the demand for new,

highly amenitized product.

3.3%

Rent Growth

(2019 AVERAGE)

10 Source: CoStar