Page 12 - Watermark_Offering Memorandum_GSP

P. 12

LOAN

REQUEST

LOAN REQUEST

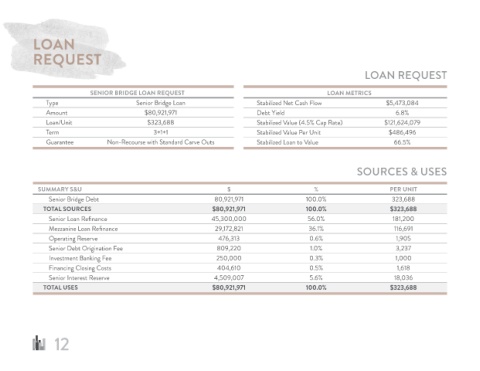

SENIOR BRIDGE LOAN REQUEST LOAN METRICS

Type Senior Bridge Loan Stabilized Net Cash Flow $5,473,084

Amount $80,921,971 Debt Yield 6.8%

Loan/Unit $323,688 Stabilized Value (4.5% Cap Rate) $121,624,079

Term 3+1+1 Stabilized Value Per Unit $486,496

Guarantee Non-Recourse with Standard Carve Outs Stabilized Loan to Value 66.5%

SOURCES & USES

SUMMARY S&U $ % PER UNIT

Senior Bridge Debt 80,921,971 100.0% 323,688

TOTAL SOURCES $80,921,971 100.0% $323,688

Senior Loan Refinance 45,300,000 56.0% 181,200

Mezzanine Loan Refinance 29,172,821 36.1% 116,691

Operating Reserve 476,313 0.6% 1,905

Senior Debt Origination Fee 809,220 1.0% 3,237

Investment Banking Fee 250,000 0.3% 1,000

Financing Closing Costs 404,610 0.5% 1,618

Senior Interest Reserve 4,509,007 5.6% 18,036

TOTAL USES $80,921,971 100.0% $323,688

12