Page 21 - FIN435 RHB vs BPMB

P. 21

3.0 Part B : The characteristics, advantages and disadvantages of the banking products

and services of RHB Bank.

RHB Bank Product And Services

I. Internet banking service

RHB now is financial services provide by RHB Bank via computer and telephone. Since the

development of technology, RHB Bank had step up to provide the best online service for the

convenience of their customer. RHB online banking or commonly known as RHB Now is a

online banking system that mainly :

To facilitate customer with online banking services such as balance check, funds

transfer , e – billing and reload service.

RHB Now e- banking consist of RHB phone banking and RHB mobile banking.

An updated system and security such as fingerprint access, secure word

authentication login and one time password for fund transfer activity.

The latest version of RHB now enables customer to transfer via mobile number,

email address and Facebook rather than bank accounts.

Other RHB online banking features include :

JomPAY : JomPAY is a National Bill Payment Scheme that allows customers to pay bills

conveniently and securely via Internet & Mobile Banking platforms such as RHB Now.

RHB-PayPal : An exclusive collaboration between RHB and PayPal, the world's No. 1 online

payment service. Together RHB and PayPal are about to change the way you transact

online. RHB-PayPal allows you to top up PayPal Account and Send Money via PayPal.

FPX : an online payment gateway that facilitates interbank transfer of funds whenever

customers make a payment for their online purchases and for business you can start

accepting payments and in return allows you to sell and grow your business more.

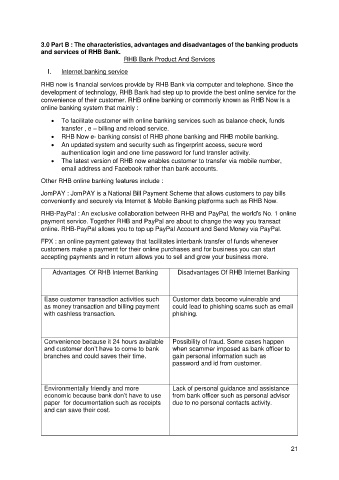

Advantages Of RHB Internet Banking Disadvantages Of RHB Internet Banking

Ease customer transaction activities such Customer data become vulnerable and

as money transaction and billing payment could lead to phishing scams such as email

with cashless transaction. phishing.

Convenience because it 24 hours available Possibility of fraud. Some cases happen

and customer don’t have to come to bank when scammer imposed as bank officer to

branches and could saves their time. gain personal information such as

password and id from customer.

Environmentally friendly and more Lack of personal guidance and assistance

economic because bank don’t have to use from bank officer such as personal advisor

paper for documentation such as receipts due to no personal contacts activity.

and can save their cost.

21