Page 26 - 2Q2021 RETAIL WEALTH ADVISORY Playbook

P. 26

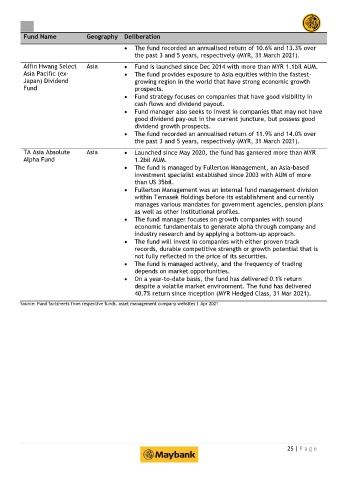

Fund Name Geography Deliberation

The fund recorded an annualised return of 10.6% and 13.3% over

the past 3 and 5 years, respectively (MYR, 31 March 2021).

Affin Hwang Select Asia Fund is launched since Dec 2014 with more than MYR 1.1bil AUM.

Asia Pacific (ex- The fund provides exposure to Asia equities within the fastest-

Japan) Dividend growing region in the world that have strong economic growth

Fund prospects.

Fund strategy focuses on companies that have good visibility in

cash flows and dividend payout.

Fund manager also seeks to invest in companies that may not have

good dividend pay-out in the current juncture, but possess good

dividend growth prospects.

The fund recorded an annualised return of 11.9% and 14.0% over

the past 3 and 5 years, respectively (MYR, 31 March 2021).

TA Asia Absolute Asia Launched since May 2020, the fund has garnered more than MYR

Alpha Fund 1.2bil AUM.

The fund is managed by Fullerton Management, an Asia-based

investment specialist established since 2003 with AUM of more

than US 35bil.

Fullerton Management was an internal fund management division

within Temasek Holdings before its establishment and currently

manages various mandates for government agencies, pension plans

as well as other institutional profiles.

The fund manager focuses on growth companies with sound

economic fundamentals to generate alpha through company and

industry research and by applying a bottom-up approach.

The fund will invest in companies with either proven track

records, durable competitive strength or growth potential that is

not fully reflected in the price of its securities.

The fund is managed actively, and the frequency of trading

depends on market opportunities.

On a year-to-date basis, the fund has delivered 0.1% return

despite a volatile market environment. The fund has delivered

40.7% return since inception (MYR Hedged Class, 31 Mar 2021).

Source: Fund factsheets from respective funds, asset management company websites | Apr 2021

25 | P a g e