Page 12 - Ready Set Retire

P. 12

Stephen J. Kelley

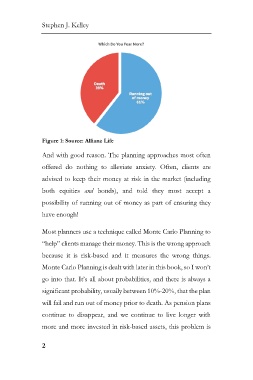

Figure 1: Source: Allianz Life

And with good reason. The planning approaches most often

offered do nothing to alleviate anxiety. Often, clients are

advised to keep their money at risk in the market (including

both equities and bonds), and told they must accept a

possibility of running out of money as part of ensuring they

have enough!

Most planners use a technique called Monte Carlo Planning to

“help” clients manage their money. This is the wrong approach

because it is risk-based and it measures the wrong things.

Monte Carlo Planning is dealt with later in this book, so I won’t

go into that. It’s all about probabilities, and there is always a

significant probability, usually between 10%-20%, that the plan

will fail and run out of money prior to death. As pension plans

continue to disappear, and we continue to live longer with

more and more invested in risk-based assets, this problem is

2