Page 126 - Ready Set Retire

P. 126

Stephen J. Kelley

the insurance industry, and it is surprising in its pinpoint

accuracy.

The premise is straightforward. Assume you have a large group

of people, say 10,000, who are in the 65-70 age group. Life

expectancy for this group is around 17 years. So, if you are 65,

you can expect to live to 82 by their calculations.

But can you? Let’s look at what life expectancy actually means.

It means that half the people in the pool are now dead, but half

are still alive. It may or may not be you. Even so, does it make

sense to think it’s possible to use that information to maximize

retirement income?

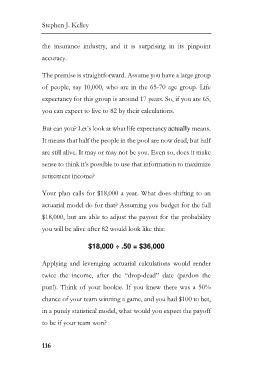

Your plan calls for $18,000 a year. What does shifting to an

actuarial model do for that? Assuming you budget for the full

$18,000, but are able to adjust the payout for the probability

you will be alive after 82 would look like this:

$18,000 ÷ .50 = $36,000

Applying and leveraging actuarial calculations would render

twice the income, after the “drop-dead” date (pardon the

pun!). Think of your bookie. If you knew there was a 50%

chance of your team winning a game, and you had $100 to bet,

in a purely statistical model, what would you expect the payoff

to be if your team won?

116