Page 34 - FY20 Annual Report Land Trusts Protection Advocacy Office_ Beneficiary Reports

P. 34

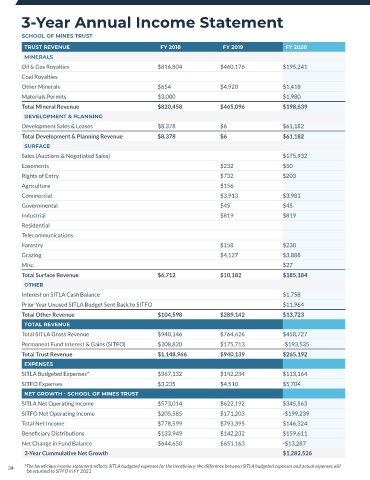

3-Year Annual Income Statement

SCHOOL OF MINES TRUST

TRUST REVENUE FY 2018 FY 2019 FY 2020

MINERALS

Oil & Gas Royalties $816,804 $460,176 $195,241

Coal Royalties

Other Minerals $654 $4,920 $1,418

Materials Permits $3,000 $1,980

Total Mineral Revenue $820,458 $465,096 $198,639

DEVELOPMENT & PLANNING

Development Sales & Leases $8,378 $6 $61,182

Total Development & Planning Revenue $8,378 $6 $61,182

SURFACE

Sales (Auctions & Negotiated Sales) $175,932

Easements $232 $50

Rights of Entry $732 $203

Agriculture $156

Commercial $3,913 $3,981

Governmental $45 $45

Industrial $819 $819

Residential

Telecommunications

Forestry $158 $238

Grazing $4,127 $3,888

Misc. $27

Total Surface Revenue $6,712 $10,182 $185,184

OTHER

Interest on SITLA Cash Balance $1,758

Prior Year Unused SITLA Budget Sent Back to SITFO $11,964

Total Other Revenue $104,598 $289,142 $13,723

TOTAL REVENUE

Total SITLA Gross Revenue $940,146 $764,426 $458,727

Permanent Fund Interest & Gains (SITFO) $208,820 $175,713 -$193,535

Total Trust Revenue $1,148,966 $940,139 $265,192

EXPENSES

SITLA Budgeted Expenses* $367,132 $142,234 $113,164

SITFO Expenses $3,235 $4,510 $5,704

NET GROWTH - SCHOOL OF MINES TRUST

SITLA Net Operating Income $573,014 $622,192 $345,563

SITFO Net Operating Income $205,585 $171,203 -$199,239

Total Net Income $778,599 $793,395 $146,324

Beneficiary Distributions $133,949 $142,232 $159,611

Net Change in Fund Balance $644,650 $651,163 -$13,287

3-Year Cummulative Net Growth $1,282,526

34 *The beneficiary income statement reflects SITLA budgeted expenses for the beneficiary; the difference between SITLA budgeted expenses and actual expenses will

be returned to SITFO in FY 2021