Page 3 - Luminex 2020 BLUE Triangles 12pg Guide w_Notices Final

P. 3

MEDICAL COVERAGE -

UNITEDHEALTHCARE

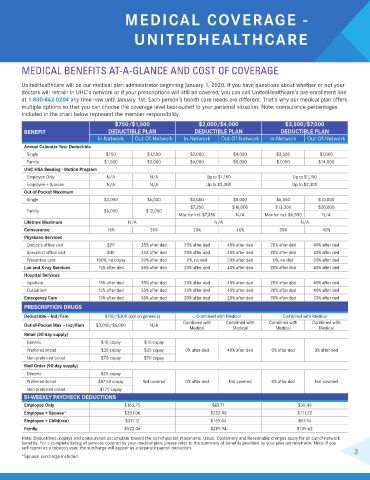

MEDICAL BENEFITS AT-A-GLANCE AND COST OF COVERAGE

UnitedHealthcare will be our medical plan administrator beginning January 1, 2020. If you have questions about whether or not your

doctors will remain in UHC’s network or if your prescriptions will still be covered, you can call UnitedHealthcare’s pre-enrollment line

at 1-800-842-0204 any time now until January 1st. Each person’s health care needs are different. That’s why our medical plan offers

multiple options so that you can choose the coverage level best-suited to your personal situation. Note: coinsurance percentages

included in the chart below represent the member responsibility.

$750/$1,500 $2,000/$4,000 $3,500/$7,000

BENEFIT DEDUCTIBLE PLAN DEDUCTIBLE PLAN DEDUCTIBLE PLAN

In-Network Out-Of-Network In-Network Out-Of-Network In-Network Out-Of-Network

Annual Calendar Year Deductible

Single $750 $1,500 $2,000 $4,000 $3,500 $7,000

Family $1,500 $3,000 $4,000 $8,000 $7,000 $14,000

UHC HSA Seeding - Motion Program

Employee Only N/A N/A Up to $1,150 Up to $1,150

Employee + Spouse N/A N/A Up to $2,300 Up to $2,300

Out-of-Pocket Maximum

Single $3,000 $6,000 $4,000 $8,000 $6,550 $10,000

$7,350 $16,000 $13,300 $20,000

Family $6,000 $12,000

Max for ind. $7,350 N/A Max for ind. $6,550 N/A

Lifetime Maximum N/A N/A N/A

Coinsurance 15% 35% 20% 40% 20% 40%

Physician Services

Doctor’s office visit $20 35% after ded 20% after ded 40% after ded 20% after ded 40% after ded

Specialist office visit $40 35% after ded 20% after ded 40% after ded 20% after ded 40% after ded

Preventive care 100%, no copay 20% after ded 0%, no ded 20% after ded 0%, no ded 20% after ded

Lab and X-ray Services 15% after ded 35% after ded 20% after ded 40% after ded 20% after ded 40% after ded

Hospital Services

Inpatient 15% after ded 35% after ded 20% after ded 40% after ded 20% after ded 40% after ded

Outpatient 15% after ded 35% after ded 20% after ded 40% after ded 20% after ded 40% after ded

Emergency Care 15% after ded 35% after ded 20% after ded 20% after ded 20% after ded 20% after ded

PRESCRIPTION DRUGS

Deductible – Ind/Fam $100/$300 (not on generics) Combined with Medical Combined with Medical

Combined with Combined with Combined with Combined with

Out-of-Pocket Max – Ind/Fam $3,000/$6,000 N/A

Medical Medical Medical Medical

Retail (30-day supply)

Generic $10 copay $10 copay

Preferred brand $35 copay $35 copay 0% after ded 40% after ded 0% after ded 0% after ded

Non-preferred brand $70 copay $70 copay

Mail Order (90-day supply)

Generic $25 copay

Preferred brand $87.50 copay Not covered 0% after ded Not covered 0% after ded Not covered

Non-preferred brand $175 copay

BI-WEEKLY PAYCHECK DEDUCTIONS

Employee Only $163.75 $83.71 $30.49

Employee + Spouse* $391.06 $222.98 $111.22

Employee + Child(ren) $311.12 $159.04 $57.94

Family $522.06 $289.94 $135.62

Note: Deductibles, copays and coinsurance accumulate toward the out-of-pocket maximums. Usual, Customary and Reasonable charges apply for all out-of-network

benefits. For a complete listing of services covered by your medical plan, please refer to the summary of benefits provided by your plan administrator. Note: If you

self-report as a tobacco user, the surcharge will appear as a separate payroll deduction. 3

*Spousal surcharge included