Page 5 - Muchmore Harrington Renewal Booklet 2020

P. 5

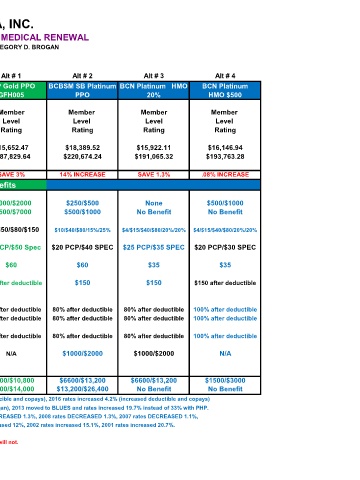

MHSA, INC.

SEPTEMBER 1, 2020 MEDICAL RENEWAL

PREPARED BY: GREGORY D. BROGAN

Current Mapped Renewal Alt # 1 Alt # 2 Alt # 3 Alt # 4

PHP Platinum PPO PHP Platinum PPO PHP Gold PPO BCBSM SB Platinum BCN Platinum HMO BCN Platinum

PFH007 PFH007 GFH005 PPO 20% HMO $500

8 employees

Member Member Member Member Member Member

Level Level Level Level Level Level

Rating Rating Rating Rating Rating Rating

Est. Monthly Premium $16,133.66 $17,108.36 $15,652.47 $18,389.52 $15,922.11 $16,146.94

Est. Annual Premium $193,603.92 $205,300.32 $187,829.64 $220,674.24 $191,065.32 $193,763.28

Includes Taxes and Fees

Change in Premium 6% INCREASE SAVE 3% 14% INCREASE SAVE 1.3% .08% INCREASE

Benefits

Deductible

In network $750/$1500 $750/$1500 $1000/$2000 $250/$500 None $500/$1000

Out Network $2500/$5000 $2500/$5000 $3500/$7000 $500/$1000 No Benefit No Benefit

Prescription drug copay $20/$40/$80/$150 $20/$50/$80/$150 $20/$50/$80/$150 $10/$40/$80/15%/25% $4/$15/$40/$80/20%/20% $4/$15/$40/$80/20%/20%

Office visit copay $20 PCP/$40 Spec $20 PCP/$40 Spec $25 PCP/$50 Spec $20 PCP/$40 SPEC $25 PCP/$35 SPEC $20 PCP/$30 SPEC

Urgent care copay $50 $50 $60 $60 $35 $35

Emergency Room Copay $150 after deductible $150 after deductible $300 after deductible $150 $150 $150 after deductible

Hospitalization

In patient 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 100% after deductible

Out patient 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 100% after deductible

Lab & X-ray 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 100% after deductible

Coinsurance Maximum N/A N/A N/A $1000/$2000 $1000/$2000 N/A

Maximum copayment

In network $2500/$5000 $2700/$5400 $5400/$10,800 $6600/$13,200 $6600/$13,200 $1500/$3000

Out network $5000/$10,000 $5000/$10,000 $7000/$14,000 $13,200/$26,400 No Benefit No Benefit

2019 rates increased 9.7%, 2018 rates increased 7.2%, 2017 rates increased 11.6% (increased deducible and copays), 2016 rates increased 4.2% (increased deductible and copays)

2015 rates increased 4.3%, 2014 moved back to PHP with a 2.9% increase (Member Level rating began), 2013 moved to BLUES and rates increased 19.7% instead of 33% with PHP.

2012 rates increased 1.5%, 2011 rates increased 14.6%, 2010 rates increased 8.8%, 2009 rates DECREASED 1.3%, 2008 rates DECREASED 1.3%, 2007 rates DECREASED 1.1%,

2006 rates increased 5.5% , 2005 rates increased 4.2%, 2004 rates increased 9.5%, 2003 rates increased 12%, 2002 rates increased 15.1%, 2001 rates increased 20.7%.

If you change carriers, deductibles will transfer over; however, coinsurance and flat dollar copays will not.

Prepared June 2020