Page 4 - Mumme Booklet

P. 4

DRAFT

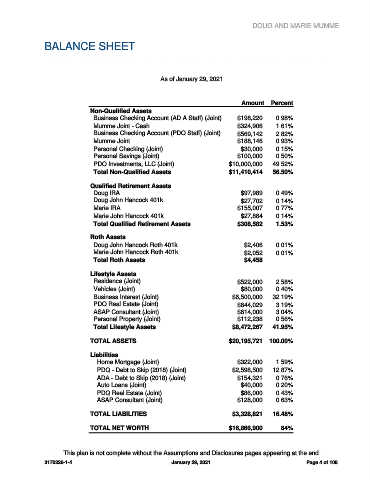

DOUG AND MARIE MUMME

BALANCE SHEET

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Cu r r e n t Fi n a n c i a l Po s i t i o n

As of January 29, 2021

Amount Percent

Non-Qualified Assets

Business Checking Account (AD A Staff) (Joint) $198,220 0.98%

Mumme Joint - Cash $324,906 1.61%

Business Checking Account (PDQ Staff) (Joint) $569,142 2.82%

Mumme Joint $188,146 0.93%

Personal Checking (Joint) $30,000 0.15%

Personal Savings (Joint) $100,000 0.50%

PDQ Investments, LLC (Joint) $10,000,000 49.52%

Total Non-Qualified Assets $11,410,414 56.50%

Qualified Retirement Assets

Doug IRA $97,989 0.49%

Doug John Hancock 401k $27,702 0.14%

Marie IRA $155,007 0.77%

Marie John Hancock 401k $27,884 0.14%

Total Qualified Retirement Assets $308,582 1.53%

Roth Assets

Doug John Hancock Roth 401k $2,406 0.01%

Marie John Hancock Roth 401k $2,052 0.01%

Total Roth Assets $4,458

Lifestyle Assets

Residence (Joint) $522,000 2.58%

Vehicles (Joint) $80,000 0.40%

Business Interest (Joint) $6,500,000 32.19%

PDQ Real Estate (Joint) $644,029 3.19%

ASAP Consultant (Joint) $614,000 3.04%

Personal Property (Joint) $112,238 0.56%

Total Lifestyle Assets $8,472,267 41.95%

TOTAL ASSETS $20,195,721 100.00%

Liabilities

Home Mortgage (Joint) $322,000 1.59%

PDQ - Debt to Skip (2018) (Joint) $2,598,500 12.87%

ADA - Debt to Skip (2018) (Joint) $154,321 0.76%

Auto Loans (Joint) $40,000 0.20%

PDQ Real Estate (Joint) $86,000 0.43%

ASAP Consultant (Joint) $128,000 0.63%

TOTAL LIABILITIES $3,328,821 16.48%

TOTAL NET WORTH $16,866,900 84%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 4 of 108