Page 7 - Mumme Booklet

P. 7

DRAFT

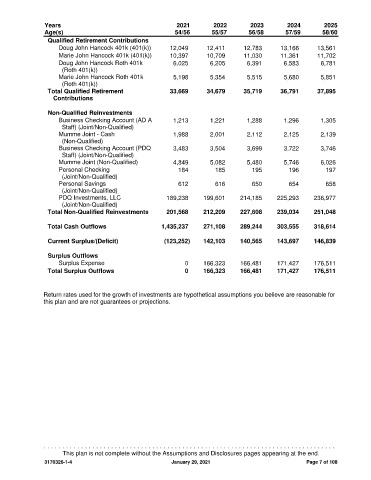

Years 2021 2022 2023 2024 2025

Age(s) 54/56 55/57 56/58 57/59 58/60

Qualified Retirement Contributions

Doug John Hancock 401k (401(k)) 12,049 12,411 12,783 13,166 13,561

Marie John Hancock 401k (401(k)) 10,397 10,709 11,030 11,361 11,702

Doug John Hancock Roth 401k 6,025 6,205 6,391 6,583 6,781

(Roth 401(k))

Marie John Hancock Roth 401k 5,198 5,354 5,515 5,680 5,851

(Roth 401(k))

Total Qualified Retirement 33,669 34,679 35,719 36,791 37,895

Contributions

Non-Qualified Reinvestments

Business Checking Account (AD A 1,213 1,221 1,288 1,296 1,305

Staff) (Joint/Non-Qualified)

Mumme Joint - Cash 1,988 2,001 2,112 2,125 2,139

(Non-Qualified)

Business Checking Account (PDQ 3,483 3,504 3,699 3,722 3,746

Staff) (Joint/Non-Qualified)

Mumme Joint (Non-Qualified) 4,849 5,082 5,480 5,746 6,026

Personal Checking 184 185 195 196 197

(Joint/Non-Qualified)

Personal Savings 612 616 650 654 658

(Joint/Non-Qualified)

PDQ Investments, LLC 189,238 199,601 214,185 225,293 236,977

(Joint/Non-Qualified)

Total Non-Qualified Reinvestments 201,568 212,209 227,608 239,034 251,048

Total Cash Outflows 1,435,237 271,108 289,244 303,555 318,614

Current Surplus/(Deficit) (123,252) 142,103 140,565 143,697 146,839

Surplus Outflows

Surplus Expense 0 166,323 166,481 171,427 176,511

Total Surplus Outflows 0 166,323 166,481 171,427 176,511

Return rates used for the growth of investments are hypothetical assumptions you believe are reasonable for

this plan and are not guarantees or projections.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 7 of 108