Page 43 - Mumme Booklet

P. 43

DRAFT

DOUG AND MARIE MUMME

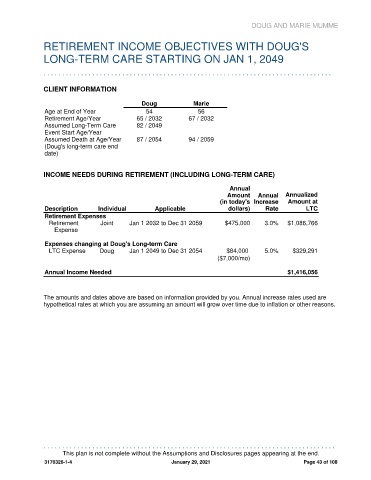

RETIREMENT INCOME OBJECTIVES WITH DOUG'S

LONG-TERM CARE STARTING ON JAN 1, 2049

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CLIENT INFORMATION

L o n g - Te r m Ca r e – Do u g

Doug Marie

Age at End of Year 54 56

Retirement Age/Year 65 / 2032 67 / 2032

Assumed Long-Term Care 82 / 2049

Event Start Age/Year

Assumed Death at Age/Year 87 / 2054 94 / 2059

(Doug's long-term care end

date)

INCOME NEEDS DURING RETIREMENT (INCLUDING LONG-TERM CARE)

Annual

Amount Annual Annualized

(in today's Increase Amount at

Description Individual Applicable dollars) Rate LTC

Retirement Expenses

Retirement Joint Jan 1 2032 to Dec 31 2059 $475,000 3.0% $1,086,766

Expense

Expenses changing at Doug's Long-term Care

LTC Expense Doug Jan 1 2049 to Dec 31 2054 $84,000 5.0% $329,291

($7,000/mo)

Annual Income Needed $1,416,056

The amounts and dates above are based on information provided by you. Annual increase rates used are

hypothetical rates at which you are assuming an amount will grow over time due to inflation or other reasons.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 43 of 108