Page 39 - Mumme Booklet

P. 39

DRAFT

DOUG AND MARIE MUMME

CURRENT PORTFOLIO TO PROPOSED ASSET

ALLOCATION COMPARISON

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

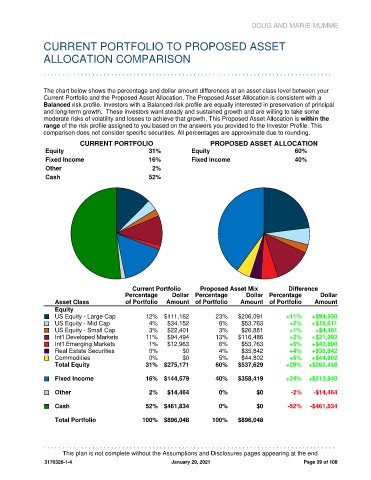

The chart below shows the percentage and dollar amount differences at an asset class level between your

Current Portfolio and the Proposed Asset Allocation. The Proposed Asset Allocation is consistent with a

Balanced risk profile. Investors with a Balanced risk profile are equally interested in preservation of principal

and long-term growth. These investors want steady and sustained growth and are willing to take some

moderate risks of volatility and losses to achieve that growth. This Proposed Asset Allocation is within the

range of the risk profile assigned to you based on the answers you provided to the Investor Profile. This

comparison does not consider specific securities. All percentages are approximate due to rounding.

CURRENT PORTFOLIO PROPOSED ASSET ALLOCATION

Equity 31% Equity 60%

Fixed Income 16% Fixed Income 40%

Other 2%

Cash 52%

Current Portfolio Proposed Asset Mix Difference

Percentage Dollar Percentage Dollar Percentage Dollar

Asset Class of Portfolio Amount of Portfolio Amount of Portfolio Amount

Equity

US Equity - Large Cap 12% $111,162 23% $206,091 +11% +$94,930

US Equity - Mid Cap 4% $34,152 6% $53,763 +2% +$19,611

US Equity - Small Cap 3% $22,401 3% $26,881 +1% +$4,481

Int'l Developed Markets 11% $94,494 13% $116,486 +2% +$21,992

Int'l Emerging Markets 1% $12,963 6% $53,763 +5% +$40,800

Real Estate Securities 0% $0 4% $35,842 +4% +$35,842

Commodities 0% $0 5% $44,802 +5% +$44,802

Total Equity 31% $275,171 60% $537,629 +29% +$262,458

Fixed Income 16% $144,579 40% $358,419 +24% +$213,840

Other 2% $14,464 0% $0 -2% -$14,464

Cash 52% $461,834 0% $0 -52% -$461,834

Total Portfolio 100% $896,048 100% $896,048

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 39 of 108