Page 37 - Mumme Booklet

P. 37

DRAFT

DOUG AND MARIE MUMME

PROPOSED ASSET ALLOCATION

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

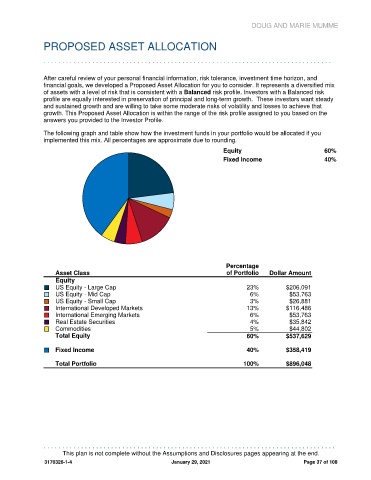

After careful review of your personal financial information, risk tolerance, investment time horizon, and

financial goals, we developed a Proposed Asset Allocation for you to consider. It represents a diversified mix

of assets with a level of risk that is consistent with a Balanced risk profile. Investors with a Balanced risk

profile are equally interested in preservation of principal and long-term growth. These investors want steady

and sustained growth and are willing to take some moderate risks of volatility and losses to achieve that

growth. This Proposed Asset Allocation is within the range of the risk profile assigned to you based on the

answers you provided to the Investor Profile.

The following graph and table show how the investment funds in your portfolio would be allocated if you

implemented this mix. All percentages are approximate due to rounding.

Equity 60%

Fixed Income 40%

Percentage

Asset Class of Portfolio Dollar Amount

Equity

US Equity - Large Cap 23% $206,091

US Equity - Mid Cap 6% $53,763

US Equity - Small Cap 3% $26,881

International Developed Markets 13% $116,486

International Emerging Markets 6% $53,763

Real Estate Securities 4% $35,842

Commodities 5% $44,802

Total Equity 60% $537,629

Fixed Income 40% $358,419

Total Portfolio 100% $896,048

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 37 of 108