Page 2 - QCHR.18 WhatYouNeedtoKnowAboutLTCI

P. 2

Who will care for you when

you can’t care for yourself?

4

hances are the day will come when you won’t be able to

Reasons to Consider

manage on your own. The good news is, people are living Long-Term Care

C longer. However, that increases the chance that you will Insurance

live to the age where you will need long-term care. 1 Allows you to stay at home

Long-term care includes all the assistance you would need with or in a setting of your choice

daily living tasks if a chronic illness or disability leaves you unable 2 Helps you maintain your

to care for yourself for an extended period of time. It could be independence and dignity

care in your own home or in a specialized facility. Can help protect your

3

Care options that may be need, but that’s an imperfect plan. retirement assets or income

available to you Many don’t recognize the significant 4 Helps relieve financial and

caregiving pressure on your

Many people think their private health negative impact caregiving could have family

insurance or Medicare would pay, on the caregiver, who often suffers

but that’s typically not true. Health emotionally and financially as a result

1

insurance really only pays for doctor of their caregiving responsibilities. need and spending down your life’s

and hospital bills. Medicare will cover If your plan is to turn to your family, savings.

skilled care for periods up to 100 is that what’s really best for you and

days, but only if certain requirements them? In short, long-term care insurance

are met. If you need care over an puts you in control. But are you the

extended period of time, you’d have Long-term care insurance right age to consider it? Can you

to spend down your assets before puts you in control afford it? And if so, what kind of

Medicaid would kick in, and then, Long-term care insurance helps make benefit features should your policy

you’d have less choice about the care sure that you’ll have access to high- include? This guide will answer these

you receive. quality care should you ever need it. questions and help determine if long-

Using insurance to pay for care also term care insurance is right for you.

Others assume their loved ones would means that you won’t need to choose

provide the care they may someday between getting the assistance you 1 Unum, Adult Caregiving, 2018

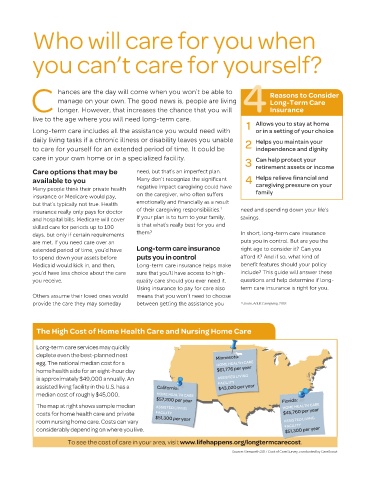

The High Cost of Home Health Care and Nursing Home Care

Long-term care services may quickly

deplete even the best-planned nest Minnesota:

egg. The national median cost for a HOME HEALTH CARE

home health aide for an eight-hour day $61,776 per year

is approximately $49,000 annually. An ASSISTED LIVING

$43,020 per year

assisted living facility in the U.S. has a California: FACILITY

median cost of roughly $45,000. HOME HEALTH CARE

$57,200 per year Florida:

The map at right shows sample median ASSISTED LIVING HOME HEALTH CARE

costs for home health care and private FACILITY $45,760 per year

$51,300 per year

room nursing home care. Costs can vary ASSISTED LIVING

$51,300 per year

considerably depending on where you live. FACILITY

To see the cost of care in your area, visit www.lifehappens.org/longtermcarecost.

Source: Genworth 2017 Cost of Care Survey, conducted by CareScout