Page 7 - QCHR.18 WhatYouNeedtoKnowAboutLTCI

P. 7

Hybrid Policies:

Long-Term Care Insurance Linked

With Life Insurance or an Annuity

For people who are concerned needs with one policy.

about their future long-term In short, you’d buy a life

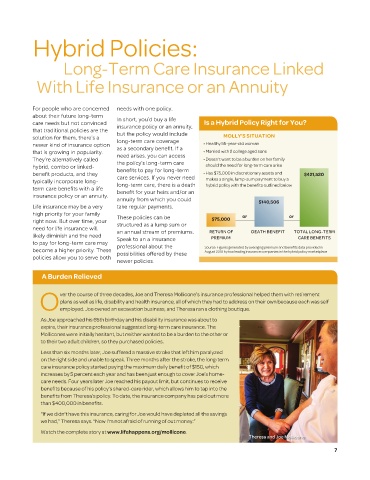

care needs but not convinced insurance policy or an annuity, Is a Hybrid Policy Right for You?

that traditional policies are the but the policy would include

solution for them, there’s a long-term care coverage MOLLY’S SITUATION

newer kind of insurance option as a secondary benefit. If a • Healthy 55-year-old woman

that is growing in popularity. need arises, you can access • Married with 2 college aged sons

They’re alternatively called the policy’s long-term care • Doesn’t want to be a burden on her family

hybrid, combo or linked- benefits to pay for long-term should the need for long-term care arise

benefit products, and they care services. If you never need • Has $75,000 in discretionary assets and $421,520

typically incorporate long- long-term care, there is a death makes a single, lump-sum payment to buy a

term care benefits with a life benefit for your heirs and/or an hybrid policy with the benefits outlined below

insurance policy or an annuity.

annuity from which you could $140,506

Life insurance may be a very take regular payments.

high priority for your family These policies can be or or

right now. But over time, your structured as a lump sum or $75,000

need for life insurance will an annual stream of premiums. RETURN OF DEATH BENEFIT TOTAL LONG-TERM

likely diminish and the need Speak to an a insurance PREMIUM CARE BENEFITS

to pay for long-term care may professional about the

become a higher priority. These possibilities offered by these Source: Figures generated by averaging premium and benefits data provided in

August 2018 by two leading insurance companies in the hybrid policy marketplace

policies allow you to serve both

newer policies.

A Burden Relieved

ver the course of three decades, Joe and Theresa Mollicone’s insurance professional helped them with retirement

plans as well as life, disability and health insurance, all of which they had to address on their own because each was self

Oemployed. Joe owned an excavation business, and Theresa ran a clothing boutique.

As Joe approached his 65th birthday and his disability insurance was about to

expire, their insurance professional suggested long-term care insurance. The

Mollicones were initially hesitant, but neither wanted to be a burden to the other or

to their two adult children, so they purchased policies.

Less than six months later, Joe suffered a massive stroke that left him paralyzed

on the right side and unable to speak. Three months after the stroke, the long-term

care insurance policy started paying the maximum daily benefit of $150, which

increases by 5 percent each year and has been just enough to cover Joe’s home-

care needs. Four years later Joe reached his payout limit, but continues to receive

benefits because of his policy’s shared-care rider, which allows him to tap into the

benefits from Theresa’s policy. To date, the insurance company has paid out more

than $400,000 in benefits.

“If we didn’t have this insurance, caring for Joe would have depleted all the savings

we had,” Theresa says. “Now I’m not afraid of running of out money.”

Watch the complete story at www.lifehappens.org/mollicone.

Theresa and Joe Mollicone

7