Page 8 - QCHC.19 Employee Benefits

P. 8

Limitations, Exceptions, & Other

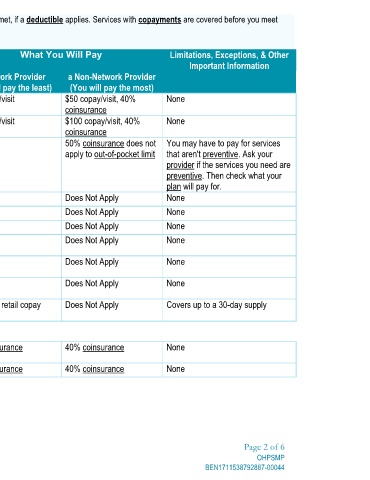

All coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies. Services with copayments are covered before you meet

Important Information You may have to pay for services that aren't preventive. Ask your provider if the services you need are preventive. Then check what your Covers up to a 30-day supply Page 2 of 6 OHPSMP BEN1711538792887-00044

None None plan will pay for. None None None None None None None None

a Non-Network Provider (You will pay the most) $50 copay/visit, 40% $100 copay/visit, 40% 50% coinsurance does not apply to out-of-pocket limit Does Not Apply Does Not Apply Does Not Apply Does Not Apply Does Not Apply Does Not Apply Does Not Apply 40% coinsurance 40% coinsurance

What You Will Pay coinsurance coinsurance

a Network Provider (You will pay the least) $25 copay/visit $50 copay/visit No charge $10 $30 $20 $60 $40 $120 Applicable retail copay applies 20% coinsurance 20% coinsurance

Services You May Need Primary care visit to treat an injury or illness Specialist visit Preventive care/ screening/ immunization Generic copay - retail Tier 1 Generic copay - home delivery Tier 1 Preferred brand copay - retail Tier 2 Preferred brand copay - home delivery Tier 2 Non-preferred brand copay - retail Tier 3 Non-preferred brand copay - home delivery Tier 3 Specialty drugs - retail Facility fee (e.g., ambulatory surgery center) Physician/surgeon fees (Outpatient)

your deductible, unless otherwise specified.

Common Medical Event If you visit a health care provider's office or clinic If you need drugs to treat your illness or condition More information about prescription drug coverage is available at MedMutual.com/SBC If you have outpatient surgery